Table of Contents

Defining Marketing for the 21st Century

Developing Marketing Strategies and Plans

Gathering Information and Scanning the Environment

Conducting Marketing Research and Forecasting Demand

Creating Customer Value, Satisfaction, and Loyalty

Analyzing Consumer Markets

Analyzing Business Markets

Identifying Market Segments and Targets

Creating Brand Equity

Crafting the Brand Position

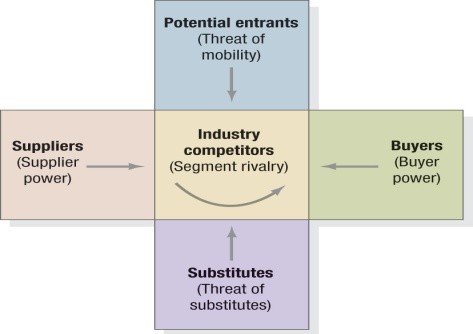

Dealing with Competition

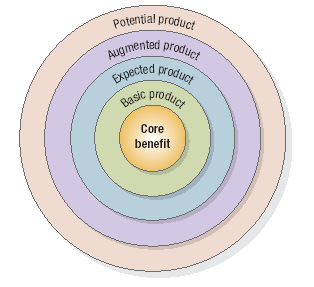

Setting Product Strategy

Designing and Managing Services

Developing Pricing Strategies and Programs

Designing and Managing Value Networks and Channels

Managing Retailing, Wholesaling, and Logistics

Additional Slides

Defining Marketing for the 21st Century

The Importance of Marketing

What is Marketing?

It deals with identifying and meeting human and social needs or “meeting needs profitably”. It is an organizational function and a set of processes for creating, communicating, and delivering value to customers and for managing customer relationships in ways that benefit the organization and its stakeholders. Marketing consists of actions undertaken to elicit desired responses from a target audience.

What is Marketing Management?

Is the art and science of choosing target markets and getting, keeping, and growing customers through creating, delivering, and communicating superior customer value or the “the art of selling products”. Peter Drucker said , “Ideally, marketing should result in a customer who is ready to buy.”

Marketing management involves these two important aspects:

- Exchange – the core of marketing; the process of obtaining the desired product form someone by offering something in return

- Transaction – is a trade of values between two or more parties

What is Marketed?

- Goods

- Services (i.e. airlines, hotels, car rental, barbers…)

- Events (concerts, trade shows)

- Experiences (Disney World, customized experiences)

- Persons (celebrity marketing)

- Places (cities, tourist attractions)

- Properties (real estate or financial property – stocks and bonds)

- Organizations (universities, museums, performing arts orgs, non-profit orgs.)

- Information (encyclopedias, magazine)

- Ideas (“Friends Don’t Let Friends Drive Drunk)

Who Markets?

Marketers and Prospects

Marketers are people who seeks a response from another party, called prospects. They are skilled in stimulating demand for a company’s products. Responsible for demand management. Seek to influence the level, timing, and composition of demand to meet the organization’s objectives

8 Possible Demand States:

- Negative demand – Consumers dislike the product and may even pay a price to avoid it

- Nonexistent demand – Consumers may be unaware or uninterested in the product.

- Latent demand – Consumers may share a strong need that cannot be satisfied by an existing product.

- Declining demand – Consumers begin to buy the product less frequently or not at all.

- Irregular demand – Consumer purchases vary on a seasonal, monthly, weekly, daily, or even hourly basis.

- Full demand – Consumers are adequately buying all products put into the marketplace

- Overfull demand – More consumers would like to buy the product than can be satisfied.

- Unwholesome demand – Consumers may be attracted to products that have undesirable social consequences.

Markets – marketers often use the term market to cover various grouping of customers

- Needs markets

- Product markets

- Demographic markets

- Geographic markets

- Voter markets

Key Customer Markets

- Consumer Markets – companies selling mass consumer goods and services spend a great deal of time trying to establish a superior brand image

- Brand strength depends on developing a superior product and packaging, ensuring its availability, and backing it with engaging communication and reliable service

- Business Markets – companies selling business goods and services often face well-trained and well-informed professional buyers who are skilled in evaluating competitive offerings

- Business marketers must demonstrate how their products will help these buyers achieve higher revenue or lower costs

- Global Markets – companies selling goods and services in the global marketplace face additional decisions and challenges

- Which countries to enter; how to enter each country’ how to adapt their product and service features to each country; how to price in different countries’ how to adapt their communication to fit different cultures

- Non-Profit and Governmental Markets

MARKETPLACES, MARKETSPACES, AND METAMARKETS

- Marketplace – physical

- Marketspace – digital

- Metamarket – cluster of complementary products and services that are closely related in the minds of consumers but are spread across a diverse set of industries

- (i.e. automobile – car dealers, financing, insurance, mechanics, spare parts dealers, service shops, auto mags, classified ads, auto sites on internet)

- “marketplace isn’t what it used to be” / How business and marketing are changing:

a. Changing technology

b. Globalization

c. Deregulation

d. Privatization

e. Customer empowerment

f. Customization

g. Heightened competition

h. Industry convergence

i. Retail transformation (growing power of giant retailers and “category killers”)

j. Disintermediation (i.e. in delivery of products and services – amazon, yahoo, eBay, etrade)

Company Orientations Towards the Marketplace

1. The Production Concept

- Consumers will prefer products that are widely available and in inexpensive

- Managers: to concentrate on achieving high production efficiency, low costs, and mass distribution

2. The Product Concept

- Consumers will favor those products that offer the most quality, performance, or innovative features

- Managers: focus on making superior products in improving them over time

3. The Selling Concept

- Consumers and businesses, if left alone, will ordinarily not buy enough of the organization’s products

- Orgs must, therefore, undertake an aggressive selling and promotion efforts

- Practice most aggressively with unsought goods: encyclopedias, insurance, funeral plots

4. The Marketing Concept

- Instead of product-centered, “make-and-sell” philosophy,

- business shifted to a customer-centered, “sense-and-respond” philosophy

- Marketing is finding the right products for your customers

- Focus on the needs of the buyer

- Satisfying the needs of the customer by means of the product and the whole cluster of things associated with creating delivering and finally consuming it

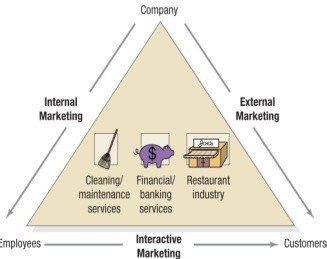

5. The Holistic Marketing Concept

- “everything matters” with marketing – broad, integrated perspective is often necessary

- Four components of Holistic Marketing:

a. Relationship Marketing – building mutually satisfying long-term relationships with key parties

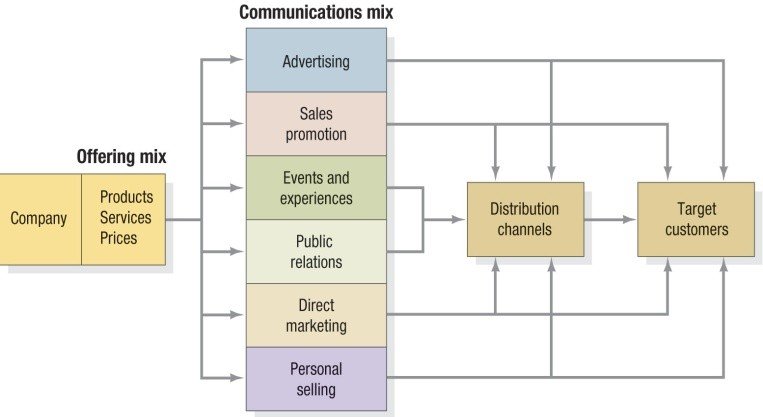

b. Integrated Marketing – devise marketing activities and assemble fully integrated marketing programs to create, communicate, and deliver value for consumers

*marketing activities come in all forms; one ex. Is in terms of marketing mix:

*figure below shows the company preparing an offering mix of products and services, and prices, and utilizing a communications mix:

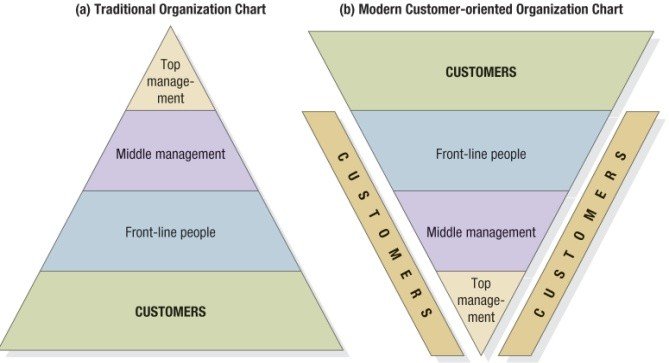

c. Internal Marketing – ensuring that everyone in the organization embraces appropriate marketing principles, especially senior management

Must take place on two levels:

• Various marketing functions must work together (sales force, advertising, CS, product management, market research)

• Marketing must be embraced by the other departments; they must also “think customer”; marketing must be pervasive throughout the company)

d. Social responsibility marketing – understanding broader concerns and the ethical, environmental, legal, and social context of marketing activities and programs

Fundamental Marketing Concepts, Trends, and Tasks

Core Concepts

NEEDS, WANTS, AND DEMANDS

- Needs: basic human requirements

- Wants: needs become wants when they are directed to specific objects that might satisfy the need

- Demands: wants for specific products backed by an ability to pay

- Marketers do not create needs: Needs preexist marketers. Marketers, along with other societal factors, influence wants.

- “Simply giving customers what they want isn’t enough anymore – to gain an edge companies must help customers learn what they want.”

Five types of needs:

1.) Stated needs 2)Real needs 3)Unstated needs 4)Delight needs 5)Secret needs

TARGET MARKETS, POSITIONING, AND SEGMENTATION

- A marketer can rarely satisfy everyone in a market

- Marketers start by dividing up the market into segments

- Decides which segments present the greatest opportunity – target markets

- For each chosen target market, firm develops a market offering

- Offering is positioned in the minds of the target buyers as delivering some central benefit(s).

- For each chosen target market, firm develops a market offering

- Decides which segments present the greatest opportunity – target markets

- Marketers start by dividing up the market into segments

OFFERING AND BRANDS (value propositions)

- Offering: can be a combination of products, services, information, and experiences

- Brand: an offering from a known source

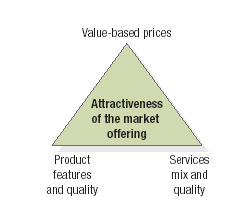

VALUE AND SATISFACTION

- Offering will be successful if it delivers value and satisfaction to the target buyer.

- Value

- reflects the perceived tangible and intangible benefits and costs to customers

- a central marketing concept; Marketing can be seen as the identification, creation, communication, delivery, and monitoring of customer value

- “customer value triad” – (qsp) value can be seen a primarily a combination of quality, service, and price

- Satisfaction – person’s comparative judgments resulting from a product’s perceived performance in relation to his expectations.

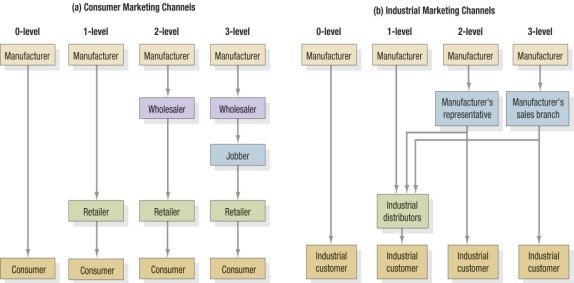

3 KINDS OF MARKETING CHANNELS:

- Communication channels deliver and receive messages from target buyers

- Distribution channels – used to display, sell, or deliver the physical product or service(s) to buyer or user.

- Service channels – used to carry out transactions with potential buyers

SUPPLY CHAIN

- Stretching from raw materials to components to final products that are carried to final buyers

- Represents a value delivery system

COMPETITION

- Includes all the actual and potential rival offerings and substitutes that a buyer might consider

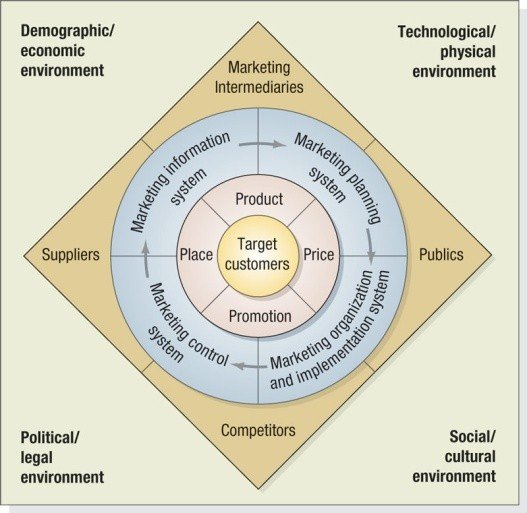

MARKETING ENVIRONMENT

- Task environment – includes the immediate actors involved in producing, distributing, and promoting the offering

- Company, suppliers, distributors, dealers, and target customers

- Broad environment consist of six components:

- Demographic environment

- Economic environment

- Physical environment

- Technological environment

- Political-legal environment

- Social-cultural environment

Factors Influencing Company Marketing Strategy

MARKET PLANNING – consists of:

- analyzing marketing opportunities;

- selecting target markets;

- designing marketing strategies;

- developing marketing programs; and

- managing the marketing effort

14 Shifts in Marketing Management

| FROM | TO |

| 1. Marketing does the marketing | Everyone Does the Marketing |

| 2. Organizing by product units | Organizing by customer segments |

| 3. Making everything | Buying more goods and services from outside |

| 4. Using many suppliers | Working with fewer suppliers in a “partnership” |

| 5. Relying on old market positions | Uncovering new ones |

| 6. Emphasizing tangible assets | Emphasizing intangible assts |

| 7. Building brands through ads | Building brands through performance and integrated communications |

| 8. Attracting customers through stores and salespeople | Making products available online |

| 9. Selling to everyone | Trying to be the best firm serving well-defined target markets |

| 10. Focusing on profitable transactions | Focusing on customer lifetime value |

| 11. Focus on gaining market share | Focus on building customer share |

| 12. Being local | Being “glocal” – both global and local |

| 13. Focusing on the financial scorecard | Focusing on the marketing scorecard |

| 14. Focusing on shareholders | Focusing on stakeholders |

Marketing Management Tasks

- Developing marketing strategies and plans

- Capturing marketing insights

- Connecting with customers

- Building strong brands

- Shaping the market offerings

- Delivering value

- Communicating value

- Creating long-term growth

Developing Marketing Strategies and Plans

Marketing and Customer Value

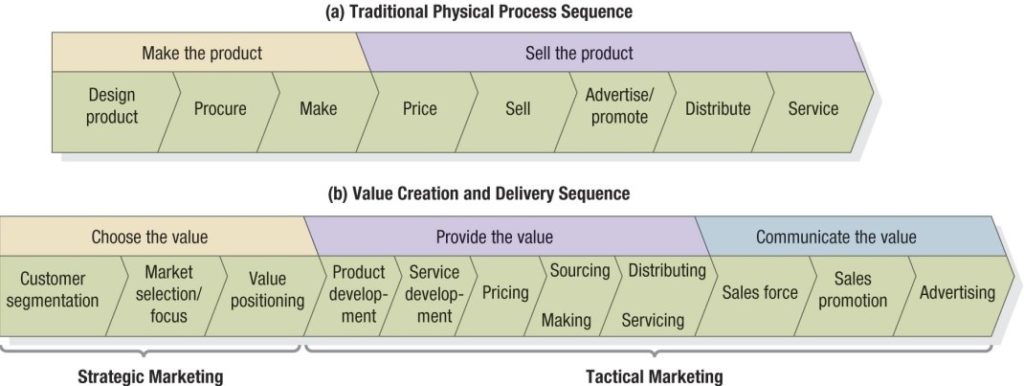

The Value Delivery Process

- STP (“segmentation, targeting, positioning”) – the essence of strategic marketing

- 3 V’s Approach to Marketing:

- Define the value segment

- Define the value proposition

- Define the value network

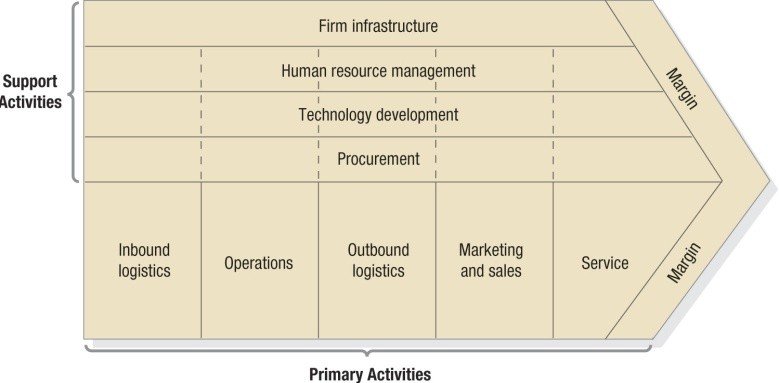

The Value Chain

Porter’s Generic Value Chain

- Michael Porter proposed the value chain as a tool for identifying ways to create more customer value

- Every firm is a synthesis of activities performed to design, produce, market, deliver, and support its product

- The firm’s task is to examine its costs and performance in each value-creating activity and to look for ways to improve it

- Benchmark (org costs & performance measures; competitor costs & performance measures)

- Study the “best of class” practices of the world’s best companies

- To be successful, a firm also needs to look for competitive advantages beyond its own operations, into the value chains of suppliers, distributors, and customers

- Study the “best of class” practices of the world’s best companies

Porter’s Generic Value Chain

Core Competencies

- To carry out its core business processes, a company needs resources

- The key then is to own, and nurture the resources and competencies that make up the essence of the business

3 characteristics of Core Competencies:

- Source of competitive advantage

- Has applications in a wide variety of markets

- Difficult for competitors to imitate

- Competitive advantage ultimately derives from how well the company has fitted its core competencies and distinctive capabilities into tightly interlocking “activity systems.”

A Holistic Marketing Orientation and Customer Value

- Value Exploration

- Cognitive space: reflects existing and latent needs; need for participation, stability, freedom, change

- Competency space: in terms of breadth (broad vs. focused scope of business) and depth (physical vs. knowledge-based cap.)

- Resource space: involves horizontal partnerships and vertical partnerships

- Value Creation

- Value Delivery

The Central Role of Strategic Planning

- Strategic planning calls for action in 3 areas:

- Managing a company’s businesses as an investment portfolio

- Assessing each business’s strength by considering the market’s growth rate and the company’s position and fit in that market

- Establishing a strategy (develop a game plan for its long-run objectives)

- Marketing plan: central instrument for directing and coordinating the marketing effort

- Strategic marketing plan

- lays out the target markets and the value proposition that will be offered, based on an analysis of the best market opportunities

- Tactical marketing plan

- specifies the marketing tactics, including product features, promotion, merchandising, pricing, sales channels, and service

- Strategic marketing plan

- Marketing plan: central instrument for directing and coordinating the marketing effort

Corporate and Division Strategic Planning

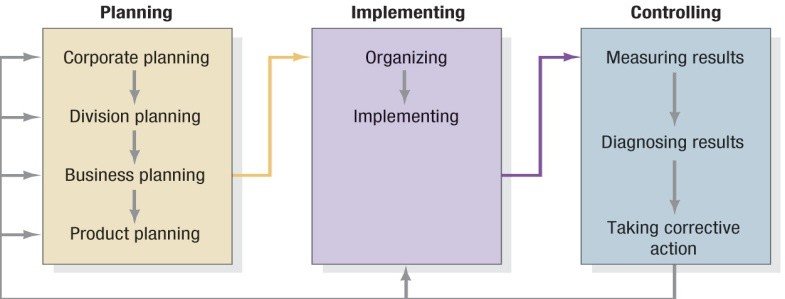

The Strategic Planning, Implementation, and Control Processes

- Defining the Corporate Mission

- Mission statements –

- Provides employees with a shared sense of purpose, direction, and opportunity

- What is our business? Who is the customer? What is of value to customer? What will our business be? What should our business be? (Peter Drucker)

- Mission statements –

- Defining the Business

- Business can be defined in terms of 3 dimensions: customer groups, customer needs, and technology

- SBUs: The purpose of identifying the company’s strategic business units is to develop separate strategies and assign appropriate funding

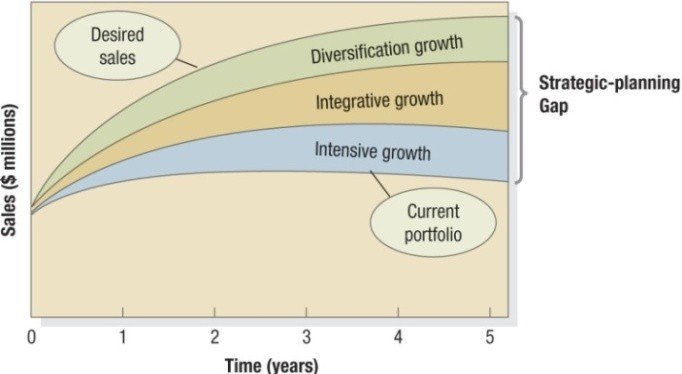

- Assessing Growth Opportunities

- Identify opportunities to achieve further growth within current businesses (intensive opportunities)

- Identify opportunities to build or acquire businesses that are related to current businesses (integrative)

- Identify opportunities to add attractive businesses that are unrelated to current businesses (diversification opportunities)

- Integrative Growth – a business’s sales and profits may be increased through backward, forward, or horizontal integration within its industry

- Diversification Growth – makes sense when good opportunities can be found outside the present businesses

- Concentric strategy – seek new products that have technological or marketing synergies with existing product lines

- Horizontal strategy – search new products that could appeal to current customers even though the new products are technologically unrelated to its current product line

- Conglomerate strategy – seek now businesses that have no relationship to its current technology, products, or markets

- Downsizing and Divesting older business

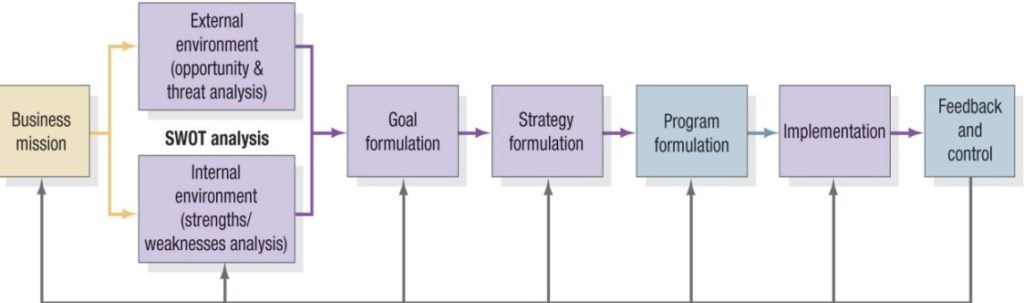

Business Unit Strategic Planning

- Business Mission

- SWOT analysis

- Goal formulation

- Strategy Formulation

- Porter’s Generic Strategies:

- Overall cost leadership

- Differentiation

- Focus

- Strategic Alliances

- Marketing Alliance:

- Product or service alliances

- Promotional alliances

- Logistics alliances

- Pricing collaborations

- Program Formulation and Implementation

- McKinsey & Company’s 7s in Successful Business Practice:

- Strategy, structure, and systems (“hardware” of success)

- Style, skills, staff, and shared values (“software” of success)

- Marketing Alliance:

Feedback and Control – track the results and monitor new developments

Product Planning: The Nature and Contents of a Marketing Plan

Contents of a Marketing Plan (sample):

- Executive summary and table of contents

- Situational analysis

- Market Summary

- Target Markets

- Market Demographics

- Geographic

- Demographic

- Behavior Factors

- Market Needs

- Market Trends

- Market Growth

- SWOT Analysis

- Competition

- Product Offering

- Keys to Success

- Critical Issues

- Market Summary

- Marketing strategy

- Mission

- Marketing objective

- Financial objective

- Target markets

- Positioning

- Strategies

- Marketing Mix

- Marketing Research

- Financial projections

- Break-even Analysis

- Sales Forecast

- Expense Forecast

- Implementation controls

- Controls

- Implementation

- Marketing Organization

- Contingency Planning

Gathering Information and Scanning the Environment

Components of a Modern Marketing Information System

- Marketing Information Systems (MIS)

- Consists of people, equipment, and procedures to gather, sort, analyze, evaluate, and distribute needed, timely and accurate information to marketing decision-makers

- Components:

- Internal company records, marketing intelligence activities

- Marketing research

- MIS should be a cross between what managers think they need, what managers really need, and what is economically feasible

Internal Records and Marketing Intelligence

- The Order-to-Payment Cycle

- Heart of the internal records system

- Sales Information Systems

- Companies must carefully interpret the sales data so as not to get the wrong signals

- Databases, Data Warehousing, and Data Mining

- The Marketing Intelligence System

- Internal records system supplies data; marketing intelligence system supplies happenings data

- A set of procedures and sources managers use to obtain everyday information about developments in the marketing environment

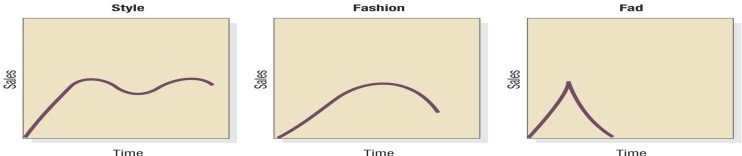

Analyzing the Macroenvironment

- Needs and Trends

- Fad: “unpredictable, short-lived, and without social, economic, and political significance.”

- Trend: a direction or sequence of events that has some momentum and durability

- Reveals the shape of the future and provides many opportunities

- Megatrend: “large social, economic, political and technological changes that are slow to form, and once in place, they influence us for some time – between seven and ten years or longer.”

- A new product or marketing program is likely to be more successful if it is in line with strong trends rather than opposed to them, but detecting a new market opportunity does not guarantee success, even if it is technically feasible.

- Identifying the Major Forces

- Represent “noncontrollables,” which company must monitor and to which it must respond

6 Major Forces:

- Demographic

- Economic

- Social-cultural

- Natural

- Technological

- Political-legal

1. Demographic Environment

- Demographic trends are highly reliable for the short and intermediate run

- Worldwide Population Growth

- A growing population does not mean growing markets unless these markets have sufficient purchasing power

- Example: China’s one-child policy – consequence: “little emperors” or “six-pocket syndrome”

- A growing population does not mean growing markets unless these markets have sufficient purchasing power

- Population Age Mix

- The growing trend toward an aging population

- For marketers, the most populous age groups shape the marketing environment (US: baby boomers, Gen. X, Gen. Y)

- Ethnic and Other Markets

- Japan mostly Japanese; US – “salad bowl” society”

- Ethnic groups have certain specific wants and buying habits

- Must be careful not to overgeneralize about ethnic groups

- Within each ethnic group are consumers who are quite different from each other

- Diversity goes beyond ethnic and racial markets

- Educational Groups

- 5 Groups: illiterates, high school dropouts, hs diplomas, college degrees, and professional degrees

- Household Patterns

- “traditional household” – consists of a husband, wife, and children

- “diverse” or “nontraditional” – single live-alones, adult live-together of one or both sexes, single-parent families, childless married couples, and empty-nesters

- Consider the special needs of nontraditional households, because they are now growing more rapidly than traditional households

- Geographical Shifts in Population

- Period of migratory movements between and within countries

- Location makes a difference in goods and service preference

2. Economic Environment

- Income distribution

- Marketers often distinguish countries with 5 income-distribution patterns:

- Very low incomes

- Mostly low incomes

- Very low, very high incomes

- Low, medium, high incomes

- Mostly medium incomes

- Marketers often distinguish countries with 5 income-distribution patterns:

- Savings, Debt, and Credit Availability (affects consumer expenditures)

- Outsourcing and Free Trade

3. Social-Cultural Environment

- Society shapes the beliefs, values, and norms that largely define the tastes and preference

- Views of themselves

- Views of others

- Views of organizations

- Views of society

- Views of nature (harmony or mastery over nature)

- Views of universe

- High persistence of core cultural values

- Marketers have some chance of changing secondary values but little chance of changing core values

- Existence of Subcultures

- Groups with shared values emerging from their special life experiences or circumstances

- Shifts of Secondary Cultural Values through time

- Cultural swings do take place (i.e. hippies, the Beatles…)

4. Natural Environment (4 trends in the natural environment)

- Shortage of Raw Materials

- Increased Energy Costs

- Anti-Pollution Pressures

- Changing Role of Governments

5. Technological Environment (Every new technology is a force for “creative destruction.”)

- Accelerating pace of change

- Unlimited opportunities for innovation

- Varying R&D Budgets

- Increased regulation of technological change

6. Political-legal Environment

- Increase in business legislation

- Growth of special-interest groups

Conducting Marketing Research and Forecasting Demand

The Market Research System

- The systematic design, collection, analysis, and reporting of data and findings relevant to a specific marketing situation facing the company

- Types of Marketing Research Firms:

- Syndicated-service firms

- Custom marketing research firms

- Specialty-line marketing research firms

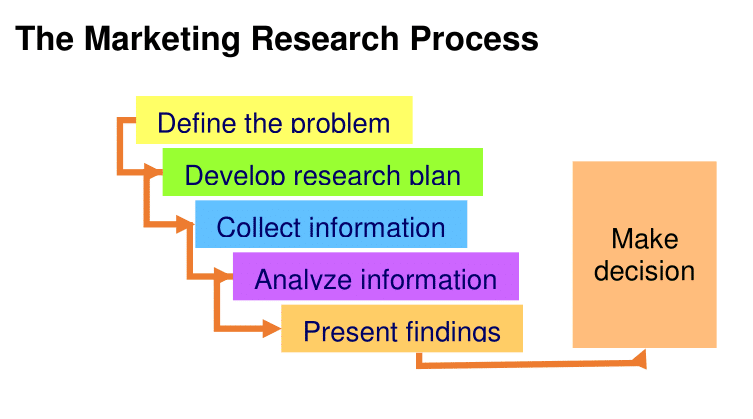

The Marketing Research Process

- Research approaches (primary data can be collected in 5 main ways)

- Observational research

- Focus group research

- Survey research

- Behavioral data

- Experimental research

- Research instruments

- Questionnaires

- Qualitative Measures – for gauging consumer opinion because consumer actions do not always match their answers to survey questions

- Shadowing

- Behavior mapping

- Consumer journey

- Camera Journals

- Extreme user interview

- Storytelling

- Unfocus groups

- Mechanical Devices (example: galvanometers and tachistoscope, eye cameras, audiometers, gps)

- Sampling Plan (sampling unit? Sampling size? Sampling procedure?)

- Contact Methods

- Mail questionnaires

- Telephone interview

- Personal interview

- Online interview

- Characteristics of Good Marketing Research:

- Scientific method

- Research creativity

- Multiple methods

- Interdependence

- Value and cost of information

- Healthy skepticism

- Ethical marketing

Measuring Marketing Productivity

Marketing Metrics

| External | Internal |

| Awareness Market share Relative price Number of complaints Customer satisfaction | Awareness of goals Commitment to goals Active support Resource adequacy Staffing |

Measuring Marketing Plan Performance

- Sales analysis

- Market share analysis

- Marketing expense-to-sales analysis

- Financial analysis

- Marketing-profitability analysis

- Determining corrective action

- Direct vs Full Costing

- Marketing-Mix Modeling – analyze data from a variety of sources, such as retailer scanner data, company shipment data, pricing, media, and promotion spending data, to understand more precisely the effect of specific marketing activities

Forecasting and Demand measurement

The Measures of Market Demand

- Potential market

- Available market

- Target market

- Penetrated market

A Vocabulary of Demand Measurement

- Market Demand

- The total volume that would be bought by a defined customer group in a defined geographical area in a defined time period in a defined marketing environment under a defined marketing program

- Market Forecast

- Market Potential

- The limit approached by market demand as industry marketing expenditures approach infinity for a given marketing environment

- Company Demand

- The company’s estimated share of market demand at alternative levels of company marketing effort in a given time period

- Company Sales Forecast

- Expected level of company sales based on a chosen marketing plan and an assumed marketing environment

- Company Sales Potential

- The sales limit approached by company demand as company marketing effort increases relative to that of competitors

Estimating Current Demand

- Total Market potential – the maximum amount of sales that might be available to all the firms in an industry during a given period, under a given level of industry marketing effort and environmental condition

- Area Market Potential

- Market-Buildup Method

- Multiple-Factor Index Method

- Industry sales and Market Sales

Estimating Future Demand

- Survey of buyers’ intentions (forecasting, purchase probability scale)

- Composite of SalesForce Opinions

- Expert Opinion

- Past-Sales Analysis

- Market-test method

Creating Customer Value, Satisfaction, and Loyalty

Customer Perceived Value

- Customers tend to be value-maximizers, within the bounds of search costs and limited knowledge, mobility, and income

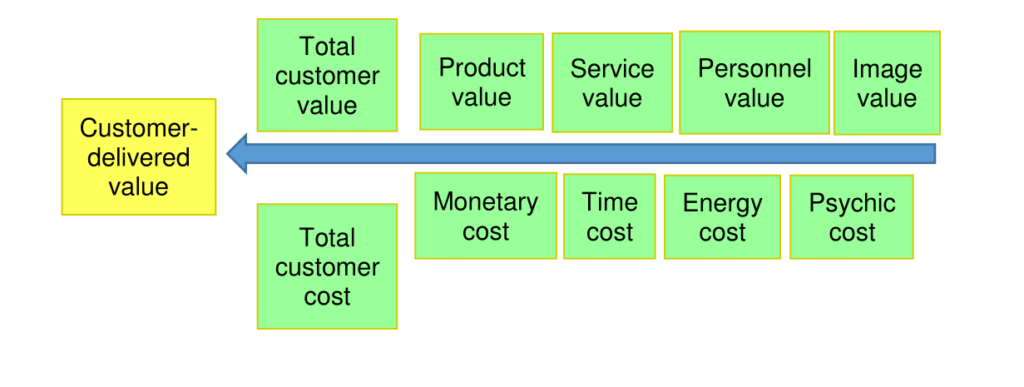

- Determinants of Customer-Delivered Value:

- Customer perceived value (CPV) – difference between the prospective customer’s evaluation of all the benefits and all the costs of an offering and the perceived alternatives

- Total Customer value –perceived monetary value of all bundle of economic, functional, and psychological benefits customers expect from a given market offering

- Total customer cost – bundle of costs customers expect to incur in evaluating, obtaining, using and disposing of the given market offering, including monetary, time, energy, and psychic costs.

- Customer perceived value is thus based on the difference between what the customer gets and what he or she gives for different possible choices.

- The marketer can increase the value of the customer offering by some combination of raising functional or emotional benefits and/or reducing one or more of the various types of costs

Delivering High Customer Value

The key to generating high customer loyalty is to deliver high customer value

- Loyalty – “a deeply held commitment to re-buy or re-patronize a preferred product or service in the future despite situational influences and marketing efforts having the potential to cause switching behavior”

- Value proposition – whole cluster of benefits the company promises to deliver

- Value–delivery system – includes all the experiences the customer will have on the way to obtaining and using the offering

Total Customer Satisfaction

- Ultimately, the company must operate on the philosophy that it is trying to deliver a high level of customer satisfaction subject to delivering acceptable levels of satisfaction to the other stakeholders, given its total resources.

- Customer Expectations – a customer’s decision to be loyal or to defect is the sum of many small encounters with the company

Measuring Satisfaction

- One key to customer retention is customer satisfaction

- High satisfaction, or delight, creates an emotional bond with the brand or company, not just a rational preference.

- Some methods used to measure customer satisfaction: Periodic surveys, customer loss rate, mystery shoppers

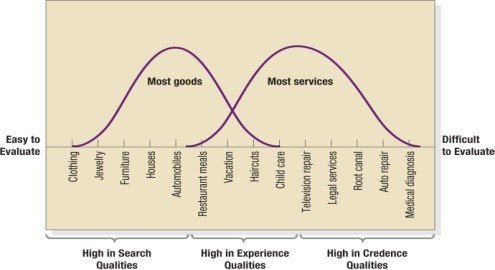

Product and Service Quality

- Satisfaction will also depend on product and service quality.

- Quality: the totality of features and characteristics of a product or service that bear on its ability to satisfy stated or implied needs (customer-centered definition)

- Seller has delivered quality whenever the seller’s product or service meets or exceeds the customers’ expectation

- Conformance quality

- Performance quality

- Total quality is the key to value creation and customer satisfaction

Total Quality Management (TQM)

- An organization-wide approach to continuously improving the quality of all the organization’s processes, products, and services.

- Higher levels of quality result in higher levels of customer satisfaction, which support higher prices and (often) lower costs.

- Studies have shown a high correlation between relative product quality and company profitability.

Maximizing Customer Lifetime Value

- Ultimately, marketing is the art of attracting and keeping profitable customers

- 20-80 rule: the top 20% of the customers may generate as much as 80% of the company’s profits

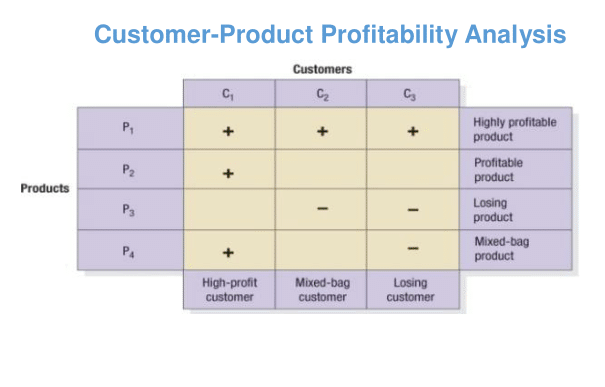

Customer-Product Profitability Analysis

Customer Profitability

- Profitable Customer – a person, household, or company that over time yields a lifetime revenue stream that exceeds by an acceptable amount the company’s cost stream of attracting, selling, and servicing that customer

- Customer profitability analysis (CPA)

- The company estimates all revenue coming from the customer, less all costs

- Marketers must segment customers into those worth pursuing versus those potentially less lucrative customers that should receive less attention if any at all

- Competitive Advantage – company’s ability to perform in one or more ways that competitors cannot or will not match

- Leverageable advantage – on that a company can use as a springboard to new advantages

- Any competitive advantage must be seen by customers as a customer advantage

Customer-Product Profitability Analysis

Measuring Customer Lifetime Value

- Customer Lifetime Value (CLV) – the net present value of the stream of future profits expected over the customer’s lifetime purchases

Customer Equity – the total of the discounted lifetime values of all of the firm’s customers; the more loyal the customer, the higher the customer equity

- 3 Drivers of Customer Equity:

- Value equity – customer’s objective assessment of the utility of an offering based on perceptions of its benefits relative to its costs

- Brand equity – customer’s subjective and intangible assessment of the brand, above and beyond its objectively perceived value

- Relationship equity – customer’s tendency to stick with the brand, above and beyond objective and subjective assessments of its worth

- Customer equity notions can be extended

- Relational equity of the firm – the cumulative value of the firm’s network of relationships with its customer, partners, suppliers, employees, and investors.

Cultivating Customer Relationships

- Maximizing customer value means cultivating long-term customer relationships

- Companies are now moving away from wasteful mass marketing to more precision marketing designed to build strong customer relationships

- Mass customization – the ability of a company to meet each customer’s requirements – to prepare on a mass basis individually designed products, services, programs, and communications

Customer Relationship Management (CRM) – the process of managing detailed information about individual customers and carefully managing all customer “touchpoints” (any occasion on which a customer encounters the brand and product) to maximize customer loyalty

- Identify prospects and customers

- Differentiate customers by needs and value to company

- Interact to improve knowledge

- Customize for each customer

Attracting, Retaining, and Growing Customers

The Customer-Development Process

- The challenge is to produce delighted and loyal customers

- 2 main ways to strengthen customer retention:

- Erect high switching barriers

- Deliver high customer satisfaction

- 96% of dissatisfied customers don’t complain; they just stop buying

- Market Dynamics:

- Permanent Capture Markets – once a customer, always a customer

- Simple Retention Markets – customers can permanently be lost after each period

- Customer Migration Markets – Customers can leave and come back

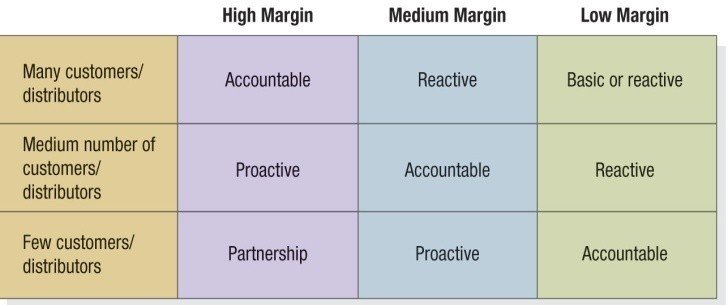

Building Loyalty

- 5 different levels of investment in customer relationship building (see figure):

Basic marketing; Reactive marketing; Accountable; Proactive; Partnership

Levels of Relationship Marketing

Reducing Customer Defection

Levels of Relationship Marketing

- Define and measure retention rate.

- Distinguish causes of customer attrition.

- Estimate profit loss associated with loss of customers.

- Assess cost to reduce defection rate.

- Gather customer feedback.

Forming Strong Customer Bonds

- Retention building approaches:

- Adding Financial Benefits

- Adding Social Benefits

- Adding Structural Ties

Customer Databases and Database Marketing

- Customer database – an organized collection of comprehensive information about individual customers or prospects that is current, accessible, and actionable for such marketing purposes as lead generation, lead qualification, sale of a product or service, or maintenance of customer relationships

- Customer mailing list, business database

- Database marketing – the process of building, maintaining, and using customer databases and other databases (products, suppliers, resellers) for the purpose of contacting, transacting, and building customer relationships

- Data warehouse – data collected by the company and organized

- Datamining – useful information about individuals, trends, and segments from the mass of data are extracted my marketing statisticians

- Use the databases to:

- Identify prospects

- Decide which customers should receive a particular offer

- Deepen customer loyalty

- Reactivate customer purchases

- Avoid serious customer mistakes

- Downside of Database Marketing and CRM

- Building and maintain a customer database requires a large in vestment

- Difficult to collect the right data, especially to capture all the occasions of company interaction with individual customers

- Building a customer database would not be worthwhile in where:

- Product is once-in-a-lifetime purchase

- Customers show little loyalty to brand

- Unit sale is very small

- Cost of gathering information is too high

- Difficulty of getting everyone in the company to be customer-oriented and to use the available information

- Not all customers want a relationship with the company, and they may resent knowing that the company has collected that much personal information about them

- Assumptions behind CRM may not always hold true

- It may not be the case that it costs less to serve more loyal customers

- Building and maintain a customer database requires a large in vestment

Analyzing Consumer Markets

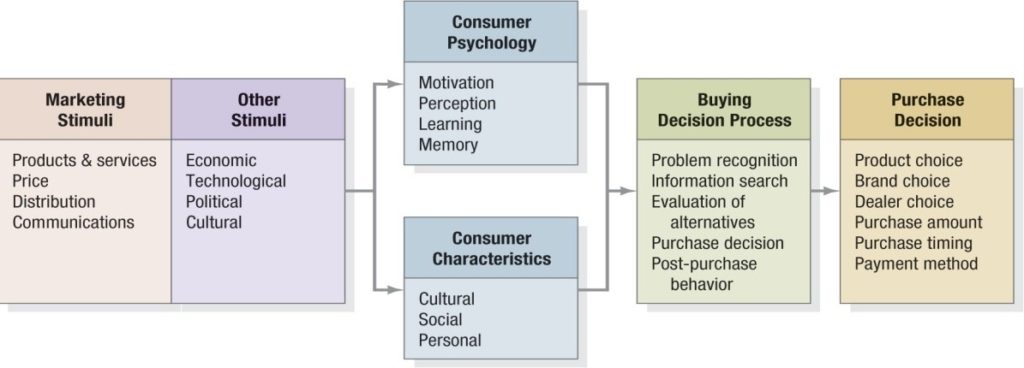

What Influences Consumer Behavior?

- Cultural Factors

- Culture – fundamental determinant of a person’s wants and behavior

- Subcultures – provide more specific identification and socialization for their members

- Social classes – a form of human societies exhibiting social stratification

- Tend to behave more alike than persons from two different social classes

- Persons are perceived as occupying inferior or superior positions according to social class

- Indicated by a cluster of variables (i.e. occupation, income, education, value orientation – rather than by any single variable

- Individuals can move up or down the social-class ladder during their lifetimes

- Social Factors

- Reference Groups – consist of all the groups that have direct (face-to-face) or indirect influence on his/her attitudes or behavior

- Membership group – groups having direct influence

- Primary groups (such as family, friends, neighbors, co-workers) – those with whom the person interacts fairly continuously and informally

- Secondary groups (such as religious, professional, and trade-union groups) – tend to be more formal and require less continuous interaction

- People are significantly influenced by their reference groups in at least 3 ways:

- Reference groups exposes an individual to new behaviors and lifestyles, and

- influence attitudes and self-concept

- create pressures for conformity that may affect actual product and brand choices

- People are also influenced by groups to which they do not belong:

- Aspirational group – those a person hopes to join

- Dissociative groups – those whose values or behavior an individual rejects

- Manufactures of products and brands where group influence is strong must determine how to reach and influence opinion leaders in these reference groups

- Membership group – groups having direct influence

- Family – most important consumer buying organization in society

- Family of orientation: parent and siblings

- Family of procreation: one’s spouse and children

- Roles and Statuses

- Role – consists of the activities a person is expected to perform

- Status – Each role carries a status

- People choose products that reflect and communicate their role and actual or desired status in society (i.e. status symbol potential of products and brands)

- Reference Groups – consist of all the groups that have direct (face-to-face) or indirect influence on his/her attitudes or behavior

- Personal Factors (have direct impact on consumer behavior)

- Age and Stage in the Life Cycle

- Taste in food, clothes, furniture, and recreation is often age related

- Consumption is also shaped by the family life cycle and the number, age, and gender of people in the household at any point in time

- Psychological life-cycle stages

- Adults experience certain “passages” or “transformations” as they go through life

- Age and Stage in the Life Cycle

- Consider also Critical Life Events or Transitions – marriage, childbirth, illness, relocation, divorce, career change, widowhood – as giving rise to new needs

- Occupation and Economic Circumstances

- i.e. design different product for brand managers, engineers, layers, and physicians

- Product choice is greatly affected by economic circumstances: spendable income, savings and assts, debts, borrowing power, attitudes toward spending and saving

- Personality and Self-concept

- Personality – a set of distinguishing human psychological traits that lead to relatively consistent and enduring responses to environmental stimuli

- Often described in terms of self-confidence, dominance, autonomy, deference, sociability, defensiveness, and adaptability

- Brand Personality – specific mix of human traits that may be attributed to a particular brand

- Sincerity; excitement; competence; sophistication; ruggedness

- Implication: these brands will attract persons who are high on the same personality traits

- Personality – a set of distinguishing human psychological traits that lead to relatively consistent and enduring responses to environmental stimuli

- Lifestyles and Values

- Lifestyle – person’s pattern of living in the world as expressed in activities, interests, and opinions

- Shaped partly by whether consumers are money-constrained or time-constrained

- Core values – the belief system that underlie consumer attitudes and behaviors

- Go much deeper than behavior or attitude; determine at a basic level, people’s choices and desires over the long term

- Occupation and Economic Circumstances

Key Psychological Processes

Model of Consumer Behavior (stimulus-response model)

4 Key Psychological Processes:

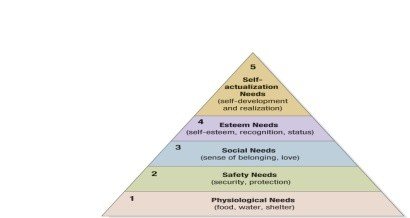

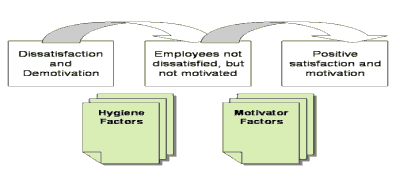

Motivation

- A person has many needs at any given time:

- Biogenic – arise from physiological state of tension such as hunger, thirst, or discomfort

- Psychogenic – arise from psychological states of tension such as need for recognition, esteem, or belonging

- Need becomes a motive when it is aroused to a sufficient level of intensity

- Motive – a need that is sufficiently pressing to drive the person to act

- Maslow’s Hierarchy of Needs – human needs are arranged from the most pressing to the least pressing. People will try to satisfy their most important needs first

- Sigmund Freud’s Theory – assumed that the psychological forces shaping people’s behavior are largely unconscious, and that a person cannot fully understand his or her own motivations

- Herzberg’s Two-Factor Theory – the absences of dissatisfiers is not enough; satisfiers must be present to motivate a purchase

Perception – the process by which an individual selects, organizes and interprets information inputs to create a meaningful picture of the world

- It is perceptions that will affect consumers’ actual behavior

- 3 Perceptual processes:

- Selective attention

- Selective Distortion

- Selective Retention

- Subliminal Perception – i.e. use of subliminal messages in ads and packages

Learning – changes in an individual’s behavior arising from experience

- Learning theorist believe that learning is produced through the interplay of drives, stimuli, cues, responses, and reinforcement

- Drive: strong internal stimulus impelling action

- Cues: minor stimuli that determine when, where, and how a person responds

- Discrimination: a countertendency to generalization; person has learned to recognize differences in sets of similar stimuli and can adjust responses accordingly

Memory

- Short-term memory (STM): temporary repository of information

- Long-term memory (LTM): permanent repository

- Associative network memory model

- Consumer brand knowledge in memory can be conceptualized as consisting of a brand node in memory with a variety of linked associations

- Brand association – consist of all brand-related thoughts, feelings, perceptions, images, experiences, beliefs, attitudes as so on that become linked to the brand node

- Memory Processes:

- Encoding – refers to how and where information gets into memory

- The more attention placed on the meaning of information during encoding, the stronger the resulting association in the memory will be

- Retrieval – refers to how information gets out of memory

- Successful recall of brand information by consumers does not depend only on the initial strength of that memory; 3 Factors are important:

- The presence of other product information in memory can produce interference effects

- The longer the time delay, the weaker the association

- Information may be “available” in memory but may not be “accessible” without the proper retrieval cues or reminders

- Successful recall of brand information by consumers does not depend only on the initial strength of that memory; 3 Factors are important:

- Encoding – refers to how and where information gets into memory

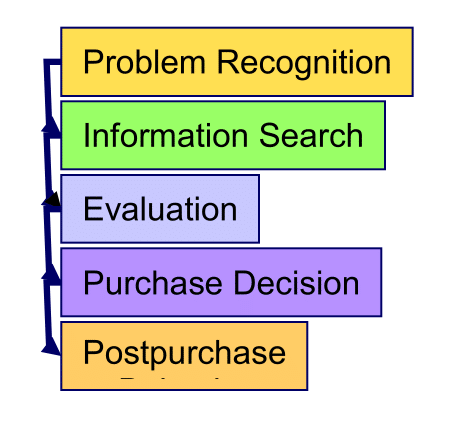

The Buying Decision Process: The Five-Stage Model

1. Problem Recognition

- Buying process start when buyer recognizes a problem or need (can be triggered by internal or external stimuli)

2. Information Search

- An aroused consumer will be inclined to search for more information

- Heightened attention – person simply becomes

more receptive to information about a product

- Active information search

- Which major information sources to which the consumer will turn and relative influence each will have on subsequent purchase decision:

- Personal

- Commercial

- Public

- Experiential

- The most effective information often comes from personal sources or public sources that are independent authorities

- Through gathering information, consumer learns about competing brands and their features

- A company must strategize to get its brand into the prospect’s awareness set, consideration set, and choice set

- Which major information sources to which the consumer will turn and relative influence each will have on subsequent purchase decision:

3. Evaluation of Alternatives

- Consumer forming judgments largely on conscious and rational basis

- Consumer is trying to satisfy a need

- Consumer is looking for certain benefits from the product solution

- Consumer sees each product as a bundle of attributes with varying abilities for delivering the benefits sought to satisfy this need

- Consumers will pay most attention to attributes that deliver the sought-after benefits

- Beliefs and Attitudes

- Expectancy-Value Model (compensatory model; perceived good things for a product can help to overcome perceived bad things)

4. Purchase Decision

- Noncompensatory Models of Consumer Choice – positive and negative attribute considerations do not necessarily net out

- Highlighting 3 Choice heuristic:

- Conjunctive heuristic – consumer sets a minimum acceptable cutoff level for each attribute and chooses the first alternative that meets the minimum standard for all attributes

- Lexicographic heuristic – consumer chooses the best brand on the basis of its perceived most important attribute

- Elimination-by-aspects heuristic – consumer compares brands on an attribute selected probabilistically and brands are eliminated if they do not meet minimum acceptable cutoff levels

- Some others (from lecture):

- Disjunctive model – at least one attribute satisfies minimum model

- Ideal Object model – ideal level each attribute is determined; compute

- Determinance model – important attributes at the same level are ignored and less important attributes are considered

- Highlighting 3 Choice heuristic:

- Intervening Factors

- Attitude of others

- The more intense the other person’s negativism and the closer the other person is to the consumer, the more the consumer will adjust his or her purchase intention

- A buyer’s preference for a brand will increase if someone he or she respects favors the same brand strongly

- Unanticipated Situational Factors

- i.e. lose of job, more urgent purchase, salesperson

- perceived risks (functional, physical, financial, social, psychological, time risk)

- Attitude of others

5. Postpurchase Behavior

- Postpurchase Satisfaction (satisfaction is a function of the closeness between expectations and the product’s perceived performance)

- Postpurchase Actions

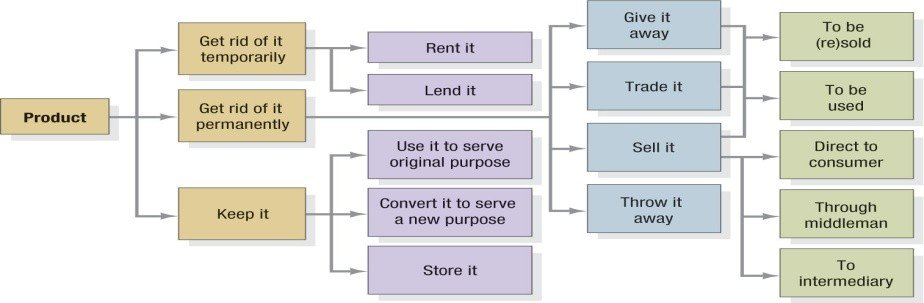

- Postpurchase Use and Disposal

Other Theories of Consumer Decision Making

- Level of Consumer Involvement

- Elaboration Likelihood Model

- An influential model of attitude formation and change, describes how consumers make evaluations in both low-and high-involvement circumstances

- Consumers follows central route (attitude formation or change involves much thought and is based on a diligent, rational consideration of the most important product or source information) only if they possess sufficient motivation, ability, and opportunity.

- If these factors are lacking, consumers will tend to follow a peripheral route (attitude formation or change involves comparatively much less thought and is a consequence of the association of a brand with either positive or negative peripheral cues) and consider less central, more extrinsic factors in their decision

- Low-Involvement Marketing Strategies (to convert a low-involvement product into one of higher one)

- Link the product to some involving issue

- Link the product to some involving personal situation

- Design advertising to trigger strong emotions

- Add an important feature

- Variety-seeking Buying Behavior

- brand switching occurs for the sake of variety rather than dissatisfaction

- Decision Heuristics and Biases

- Heuristics – rules of thumb or mental shortcuts in the decision process

- Heuristics can come into play when consumers forecast the likelihood of future outcomes or events

- Available heuristic – consumers base their predictions on the quickness and ease with which a particular example of an outcome comes to mind

- Representative heuristic – consumers base their predictions on how representative or similar the outcome is to other examples

- Anchoring and Adjustment Heuristic – consumers arrive at an initial judgment and then make adjustments of that first impression based on additional information

- Mental Accounting

- Consumers tend to segregate gains (listing multiple befits of a large industrial product can make the sum of the parts seem greater than the whole)

- Consumers tend to integrate losses (selling something if the cost can be added to another large purchase)

- Consumers tend to integrate smaller losses with larger gains (“cancellation principle” i.e. withholding taxes)

- Consumers tend to segregate small gains from large losses (may explain popularity of rebates)

- Elaboration Likelihood Model

- Profiling the Customer Buying Decision Process

- Introspective method – how they themselves would act

- Retrospective method – interview recent purchases asking them to recall the events leading to their purchase

- Prospective method – locate consumers who plan to buy the product and ask them to think out loud about going through the busying process

- Prescriptive method – ask consumers to describe the ideal way to buy the product

Analyzing Business Markets

What is Organizational Buying? – the decision-making process by which formal organizations establish the need for purchased products and services and indentify, evaluate, and choose among alternative brands and suppliers

Business Market versus the Consumer Market

- Business Market – consists of all the organizations that acquire goods and services used in the production of other products or services that are sold, rented, or supplied to others

- Fewer, larger buyers

- Close supplier-customer relationship

- Professional purchasing

- Several buying influences

- Multiple sales calls

- Derived demand – the demand for business goods is ultimately derived from the demand for consumer goods

- Inelastic demand – the total demand for many business goods and services is inelastic – not much affected by price changed

- Especially inelastic in the short run because producers cannot make quick changes in production methods

- Demand is also inelastic for business goods that represent a small percentage of the item’s total cost

- Fluctuation demand – tend to be more volatile

- Acceleration effect: sometimes a rise of only 10% in consumer demand can cause as much as 200% rise in business demand in the next period; 10% fall in consumer demand may cause a complete collapse in business demand

- Geographically concentrated buyers

- Direct purchasing (from manufacturers rather than through intermediaries)

Buying Situations (the number of decisions depends on the buying situation: complexity of the problem being solved, newness of the buying requirement, number of people involved, and time required)

- Straight Rebuy

- Modified Rebuy

- New Task

Systems Buying and Selling

- Systems buying – business buyers preferring to by a total solution to a problem form one seller

- Systems contracting

Participants in the Business Buying Process

- The Buying Center – composed of all those individuals and groups who participate in the purchasing decision-making process, who share some common goals and the risks arising from the decisions

- Includes all members of the organization who play any of seven roles in purchase decision process:

- Initiators

- Users

- Influencers

- Deciders

- Approvers

- Buyers

- Gatekeepers

Buying Center Influences

- Usually include several participants with differing interests, authority, status, and persuasiveness

- Business buyers respond to many influences when they make their decision

- Personal motivations, perceptions, preferences

- Influenced by age, income, education, job position, personality, attitudes toward risk, and culture

- Personal motivations, perceptions, preferences

- Personal needs “motivate” the behavior of individuals but organizational needs “legitimate” the buying decision process and its outcomes

- People are not buying “products,” they are buying solutions to two problems: org’s economic and strategic problem and their own personal “problem” of obtaining individual achievement and reward

Buying Center Targeting (types of business customers)

- Price-oriented customers (transactional selling) – price is everything

- Solution-oriented customers (consultative selling) – want low prices but will respond to arguments about lower total cost or more dependable supply or service

- Gold-standard customers (quality selling) – want the best performance in terms of product quality, assistance, reliable delivery, and so on

- Strategic-value customers (enterprise selling) – want a fairly permanent sole-supplier relationship with your company

The Purchasing/ Procurement Process

- In principle, business buyers seek to obtain the highest benefit package (economical, technical, service, and social) in relation to a market offering’s cost

- It is the marketer’s task to construct a profitable offering that delivers superior customer value to the target buyers

Purchasing Orientations

- Buying orientation – purchase’s focus is short term and tactical; buyers are rewarded on their ability to obtain the lowest price form suppliers for the given level of quality and availability

- Procurement orientation – buyers simultaneously seek quality improvements and cost reductions; buyers develop collaborative relationships, negotiate long-term contracts

- Supply Chain Management Orientation – purchasing’s role is further broadened to become a more strategic, value-adding operation; working towards building a seamless supply chain management system from the purchase of raw materials to the on-time arrival of finished goods to the end users.

Types of Purchasing Processes (depending on the types of products involved)

- Routine products

- Leverage products

- Strategic products

- Bottleneck products

Stages in the Buying Process

Managing Business-to-Business Customer Relationships

The Benefits of Vertical Coordination

Categories of Buyer-Seller Relationships:

- Basic buying and selling

- Bare bones

- Contractual transaction

- Customer supply

- Cooperative systems

- Collaborative

- Mutually adaptive

- Customer is king

- Study: the closest relationships between customers and suppliers arose when the supply was important to the customer and when there were procurement obstacles such as complex purchase requirements and few alternative suppliers

- The greater vertical coordination between buyer and seller through information exchange and planning is usually necessary only when high environmental uncertainty exists and specific investments are modest

Business Relationships: Risk and Opportunism

- Vertical coordination can facilitate stronger customer-seller ties but at the same time may increase the risk to the customer’s and supplier’s specific investments

- Transaction theory: because investments are partially sunk, they lock in the firms that make the investments to a particular relationship

- Buyer may be vulnerable to holdup because of switching costs

- Supplier may be more vulnerable to holdup in future contracts because of dedicated assets and/or expropriation of technology/knowledge

- When buyers cannot easily monitor supplier performance, the supplier might shrink or cheat and not deliver the expected value

- Opportunism – some form of cheating or undersupply relative to an implicit or explicit contract

- Concern as firms must devote resources to control and monitoring that otherwise could be allocated to more productive purposes

- Opportunism – some form of cheating or undersupply relative to an implicit or explicit contract

Institutional and Government Markets

- Institutional market – consists of schools, hospitals, nursing homes, prisons, and other institutions that must provide goods and services to people in their care

- Characterized by low budgets and captive clients

- Government – typically require suppliers to submit bids; subject to public review; decision making delays

Identifying Market Segments and Targets

Levels of Market Segmentation

- Mass marketing – engages in the mass production, mass distribution ,and mass productions of one product for all buyers

- Argument for mass marketing is that it creates the largest potential market, which leads to the lowest costs, which in turn can lead to lower prices or higher margins

Segment Marketing

- Market segment – consists of a group of customers who share a similar set of needs and wants

- Marketer does not create the segments; the marketer’s task is to identify the segments and decide which one(s) to target

- Flexible market offering consists of two parts:

- Naked solution – containing the product and service elements that all segment members value

- Discretionary options – some members value

- One way to define market segments is by identifying Preference Segments:

- Homogeneous preference – a market where all the consumers have roughly the same preferences

- Diffused preferences – consumer preference may be scattered throughout the space indicating that consumers vary greatly in their preferences

- Clustered preference – market might reveal distinct preference clusters call natural market segments

Niche Marketing – Customer group seeking a distinctive mix of benefits

- Characterized as follows:

- Customer have distinct set of needs; will pay a premium to the firm that best satisfies their needs

- Niche is not likely to attract other competitors

- Gains certain economies through specialization’

- Has size, profit, and growth potential

- Niche marketers presumably understands their customer’s needs so well that the customers willingly pay a premium

- Globalization has facilitated niche marketing

Local Marketing – leading to marketing programs tailored to the needs and wants of local customer groups

- Grassroots marketing – marketing activities concentrate on getting as close and personally relevant to individual customers as possible

- Experiential marketing

Customerization – combines operationally driven mass customization with customized marketing in a way that empowers consumers to design the product and service offering of their choice

- A company is customerized when it is able to respond to individual customers by customizing its products, services and messages on a one-to-one basis

Segmenting Consumer Markets (Basis for Segmenting Markets)

Geographic Segmentation

- Calls for dividing the market into different geographical units such as nations, state, regions, countries, cities, or neighborhoods

- Company can operate in one or a few areas, or operate in all but pay attention to local variations

Demographic Segmentation

- Market is divided into groups on the basis of variables such as age, family size, family life cycle, gender, income, occupation, education, religion, race, generation, nationality, and social class

- Popularity of demographic variable because:

- Consumer needs, wants and usage rates and product and brand preference are often associated with demographic variables

- Popularity of demographic variable because:

- Age and Life-Cycle Stages – consumer wants and abilities change with age

- Life Stage – defines a person’s major concern, such as going through a divorce, going into a second marriage, taking care of an older parent…

- Present opportunities for marketers who can help people cope with their major concerns

- Gender – men and women tend to have different attitudinal and behavioral orientations based partly on genetic makeup and partly on socialization

- Income -… income does not always predict the best customers for a given product

- Generation – each generation is profoundly influenced by the times in which it grow up – the music, movies, politics, and defining events of that period –cohorts

- Members of a cohort share the same major cultural, political, and economic experiences

- Social class

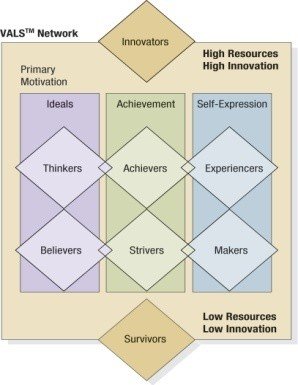

Psychographic Segmentation

- Psychographic – the science of using psychology and demographics to better understand consumers

- Buyers are divided into different groups on the basis of psychological/personality traits, lifestyle, or values

- People within the same demographic group can exhibit very different psychographic profiles

- Major tendencies of 4 groups with higher resources

- Innovators

- Thinkers

- Achievers

- Experiences

- Major tendencies of 4 groups with lower resources:

- Believers

- Strivers

- Makers

- Survivors

Behavioral Segmentation

- Buyers are divided into groups on the basis of their knowledge of, attitude toward, use of, or response to a product

Decision Roles – 5 roles in a buying decision:

- Initiator

- Influencer

- Decider

- Buyer

- User

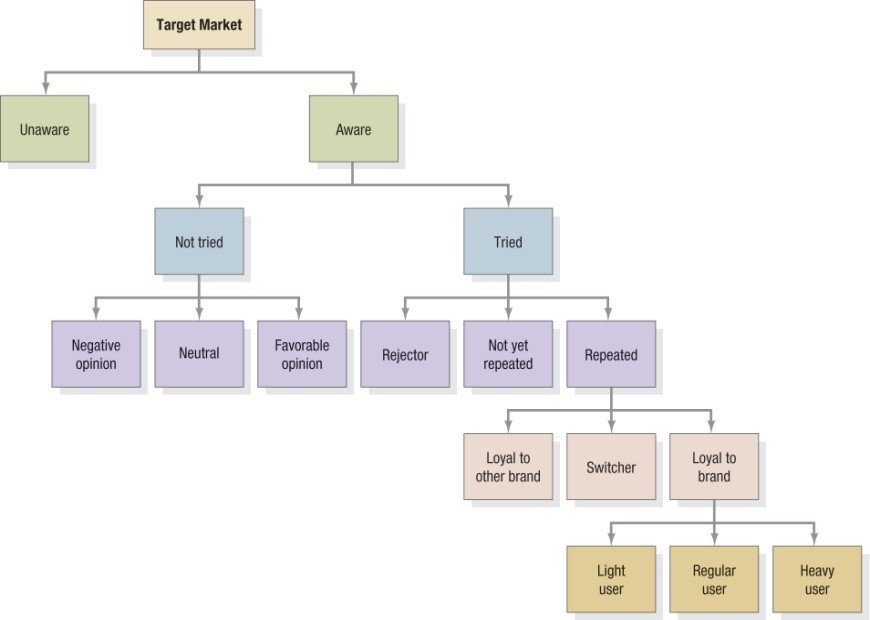

Behavioral Variables

Behavioral Segmentation Breakdown Example

- Occasions (time of day, week…; occasions when they develop a need, purchase or use a product; or particular holidays)

- Benefits (they seek)

- User status (nonusers, ex-users, potential, first-time users, regular users)

- Usage rate (light, medium, heavy)

- Buyer-readiness state

- Loyalty status

- Hard-core loyals

- Split loyals

- Shifting loyals

- Switchers

- Attitude

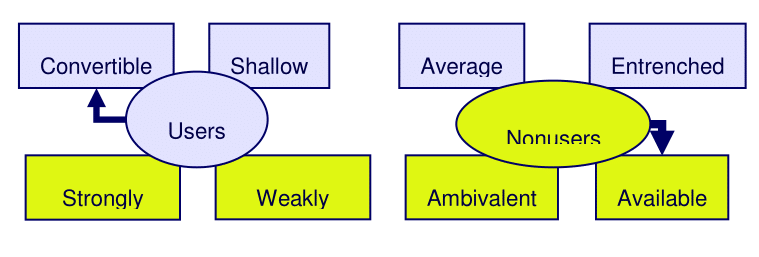

Conversion Model – been developed to measure the strength of the psychological commitment between brands and consumers and their openness to change

Bases for Segmenting Business Markets

- Business markets can be segmented with some of the same variables used in consumer market segmentation, such as geography, benefits sought, and usage rate, but business marketers also use other variables –

- Operating variables (technology customer is using, user or nonuser status, customer capabilities)

- Purchasing approaches (purchasing-function organization, power structure, nature or existing relationships, general purchase policies, purchasing criteria)

- Situational Factors (urgency, specific application, size of order)

- Personal Characteristics (buyer-seller similarity, attitudes toward risk, loyalty)

Marketing to Small Businesses

- (US: Small businesses have become a holy grail for business marketers; accounting for 50% of GNP, growing 11% annually – 3% higher than growth of large companies)

Sequential Segmentation

- Business marketers generally identify segments through a sequential process

- Macrosegmentation> Microsegmentation

- Business buyers seek different benefit bundles based on their stage in the purchase decision process:

- First-time prospects

- Novices

- Sophisticates

- Classification of business buyers (warranting a different type of selling)

- Price-oriented customers (transactional selling)

- Solution-oriented customers (consultative selling)

- Strategic-value customers (enterprise selling)

- Classification of business buyers (warranting a different type of selling)

- Price-oriented customers (transactional selling)

- Solution-oriented customers (consultative selling)

- Strategic-value customers (enterprise selling)

Market Targeting

- Once the firm has identified its market-segment opportunities, it has to decide how many and which ones to target

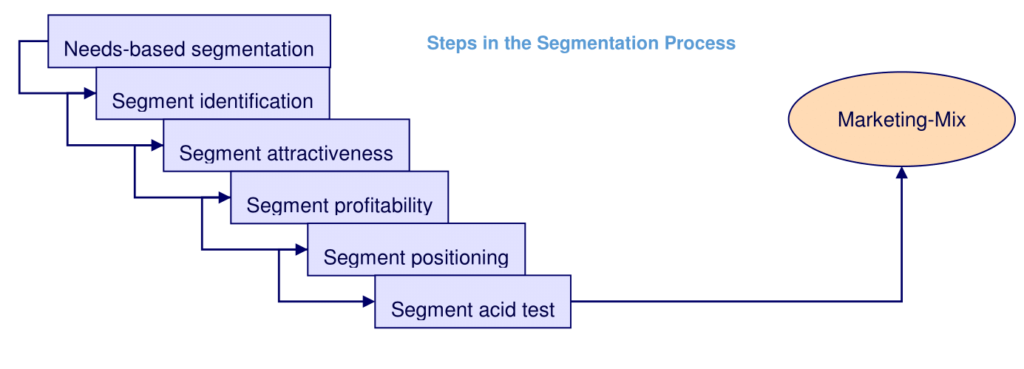

Steps in the Segmentation Process

- Needs- Based: group customers into segments based on similar needs and benefits sought by customer in solving a particular consumption problem

- Segment Identification: For each needs-based segment, determine which demographics, lifestyles, and usage behaviors make the segment distinct and identifiable (actionable)

- Segment Attractiveness: Using predetermined segment attractiveness criteria (such as market growth, competitive intensity, and market access), determine the overall attractiveness of each segment

- Segment Profitability: determine segment profitability

- Segment Positioning: For each segment, create a “value proposition” and product-price positioning strategy based on that segment’s unique customer needs and characteristics

- Segment “Acid-Test”: Create “segment storyboards” to test the attractiveness of each segment’s positioning strategy

- Marketing-Mix Strategy: Expand segment positioning strategy to include all aspects of the marketing mix: product, price, promotion, and place

Effective Segmentation Criteria – To be useful, market segments must rate favorably on five key criteria:

- Measurable

- Substantial

- Accessible

- Differentiable

- Actionable

Evaluating and Selecting the Market Segments

- In evaluating different market segments, the firm must look at two factors:

- Segment’s overall attractiveness

- Company’s objectives and resources

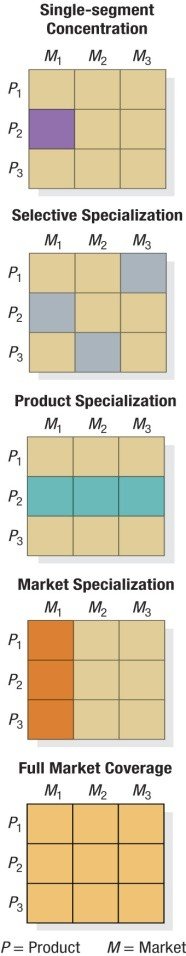

- 5 patterns of target market selection:

- Single-Segment Concentration

- Selective Specialization

- Product Specialization – firm makes certain product that it sells to several different market segments

- Market Specialization – concentrates on serving many needs of a particular customer group

- Full Market Coverage

- Undifferentiated marketing – ignores segment differences and goes after the whole market with one offer; mass distribution and advertising

- Differentiated marketing – operates in several market segments and designs different products for each segment

- Managing Multiple Segments – best way is to appoint segment managers with sufficient authority and responsibility for building the segment’s business

- Differentiated Marketing Costs – typically creates more total sales than undifferentiated marketing; also increases cost of doing business

- Product modification costs

- Manufacturing costs

- Administrative costs

- Inventory costs

- Promotion costs

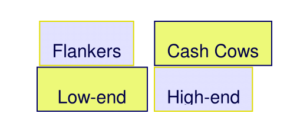

Additional Considerations

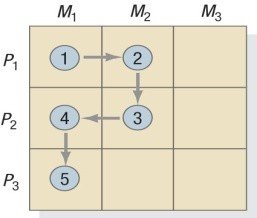

- Segment-by-segment invasion plans – a company would be wise to enter one segment at a time; competitor must not know to what segment(s) the firm will move next

Example: PepsiCo – first attacked Coca-cola in grocery market, then vendo, then fast-food market

Toyota – first gain a foothold in a market (introduced small cars), then enter new segments (midsize,

and then luxury cars)

- Megamarketing

- The strategic coordination of economic, psychological, political, and public relations skills, to gain the cooperation of a number of parties in order to enter or operate in a given market

- Used in entering blocked markets

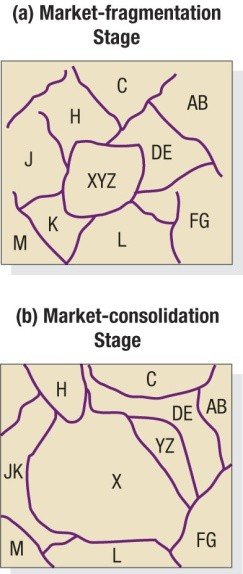

- Updating Segmentation Scheme – market segmentation analysis must be done periodically becausesegments change

- Market partitioning

- One way to discover new segment

- Process of investigating the hierarchy of attributes consumers examine in choosing a brand if they use phased decision strategy

- Hierarchy of attributes can reveal customer segments

- Market partitioning

- Ethical choice of market targets

- Market targeting sometimes generates public controversy;

- public is concerned when marketers take unfair advantage of vulnerable groups or disadvantaged groups or promote harmful products

- Socially responsible marketing calls for targeting that serves not only the company’s interest, but also the interest of those targeted

- Market targeting sometimes generates public controversy;

STP: Segmenting, Targeting, Positioning

Creating Brand Equity

What is Brand Equity?

- Brand – a name, term, sign, symbol, or design, or a combination of them, intended to identify the goods or services of one seller or group of sellers and to differentiate them from those of competitors

- Branding – a means to distinguish the goods of one producer from those of another

Role of Brands

- Brands identify the source or maker of a product and allow consumers to assign responsibility to a particular manufacturer or distributor

- Customers may evaluate identical products differently depending on how it is branded

- Consumers learn about brands through past experiences with the product and its marketing program

- For consumers: Brands’ ability to simplify decision making and reduce risk

- Brands also perform value to firms

- Simplify product handling or tracing

- Brand offers the firm legal protection for unique features or aspects of the product; ensures that firm can safely invest in the brand and reap benefits of a valuable asset

- Brand name – protected through registered trademarks; Manufacturing process – patents Packaging – copyrights and designs

- Brand can signal a certain level of quality

- Brand loyalty provides predictability (also price premium) and security of demand for the firm and creates barriers to entry that make it difficult for other firms to enter the market

- Branding can be seen as a powerful means to secure a competitive advantage

- To firms, brands represent enormously valuable pieces of legal property that can:

- influence consumer behavior,

- be bought and sold, and

- provide the security of sustained future revenues to their owner

Attributes of Strong Brands

- Excels at delivering desired benefits

- Stays relevant

- Priced to meet perceptions of value

- Positioned properly

- Communicates consistent brand messages

- Well-designed brand hierarchy

- Uses multiple marketing activities

- Understands consumer-brand relationship

- Supported by organization

- Company monitors sources of brand equity

The Scope of Branding

- Branding – endowing products and services with the power of brand; all about creating differences

- Key to branding: consumers must not think that all brands in the category are the same

- Branding can be applied virtually anywhere a consumer has a choice:

- Physical good, a service, a store, a person, a place, an organization, or an idea

Defining Brand Equity

- Brand Equity – the added value endowed to products and services

- Reflected in how consumers think, feel, and act with respect to the brand, as well as prices, market share, and profitability that the brand commands for the firm

- An important intangible asset that has psychological and financial value to the firm

- The power of a brand lies in the minds of existing or potential customers and what they have experienced directly and indirectly about the brand

- Customer-based equity – the differential effect that brand knowledge has on consumer response to the marketing of that brand

- 3 ingredients to customer-based equity:

- Brand equity arises from differences in consumer response

- Differenced in response are a result of consumer’s knowledge about the brand

- Brand knowledge – consists of all the thoughts, feelings, images, experiences, beliefs, and so on that become associated with the brand

- The differential response by consumers that makes up the brand equity is reflected in perceptions, preferences, and behavior related to all aspects of the marketing of brand

- 3 ingredients to customer-based equity:

- Marketing Advantages of Strong Brands:

- Improved perceptions of product performance

- Greater loyalty

- Less vulnerable to competition

- Less vulnerable to crises

- Larger margins

- Inelastic consumer response to price increases

- Elastic consumer response to price decreases

- Greater trade cooperation

- Increase in effectiveness of IMC

- Licensing opportunities

- Brand extension opportunities

Brand Equity as a Bridge

- All marketing dollars spent each year on the products and services should be thought of as investments in consumer brand knowledge (*quality of investment in brand building against quantity, beyond some minimal threshold amount)

- Brand Promise – the marketer’s vision of what the brand must be and do for consumers

- True value and future prospects of a brand rest with consumers, their knowledge about the brand, and their likely response to marketing activity as a result of this knowledge

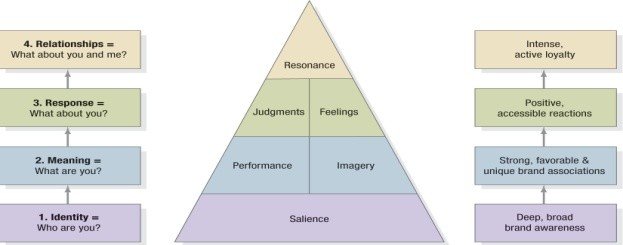

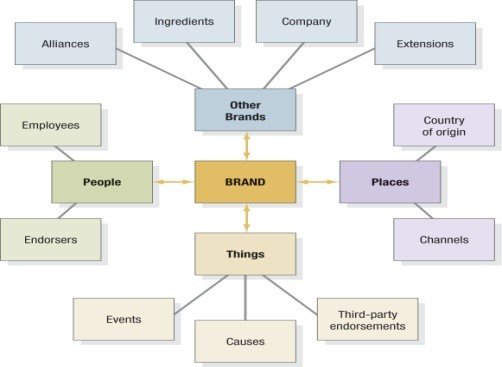

Brand Equity Models:

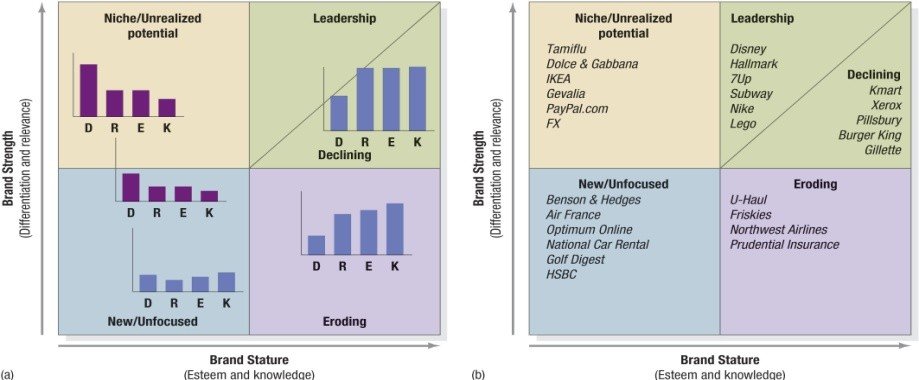

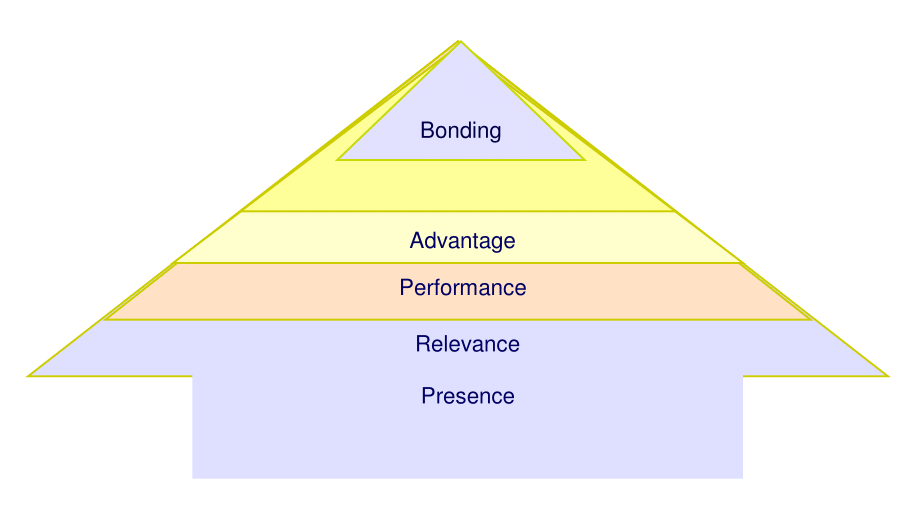

- Brand Asset Valuator (from Young and Rubicam (Y&A) ad agency)

- 4 pillars/ components of brand equity: Differentiation; Relevance; Esteem; Knowledge

BAV Power Grid

- examining the relationships among these four dimensions reveals much about its current & future status

- Aaker Model (by David Aaker)

- Views brand equity as a set of 5 categories of brand assets and liabilities linked to a brand that add or subtract from the value provided by a product or service to a firm and/or to that firm’s customers

- Brand loyalty

- Brand awareness

- Perceived quality

- Brand associations

- Other proprietary assets such as patents, trademarks, and channel relationships

- Brand Identity – the unique set of brand associations that represent what the brand stands for and promises to customers

- Brand-as product (product scope, attributes, quality/value, uses, users, country of origin)

- Brand-as-organization (org attributes, local vs. global)

- Brand-as-person (brand personality, bran-customer relationships

- Brand-as-symbol (visual imagery/metaphors and brand heritage)