Table of Contents

Role of Financial Manager

Financial Analysis

Quality of Earnings

Financial Planning

Working Capital Management

Cash Management

Capital Budgeting

Corporate Financing

Role Of Financial Manager

- Monitor financial health and threats thereof -Financial analysis and forecasting

- Guide/direct the company’s investment decisions – Capital budgeting and working capital policy/management

- Direct the company’s financing decisions – Capital structure, debt policy, dividend policy

Financial Analysis

The objective is to assess:

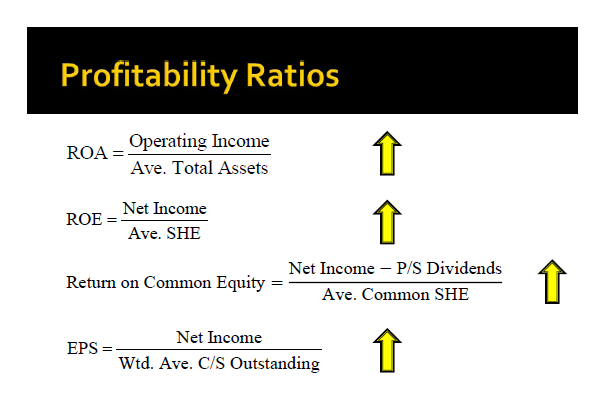

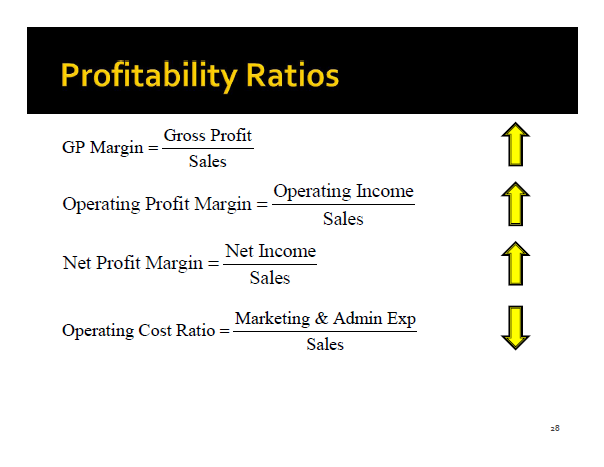

Profitability

- Return on investment

- Return on investment

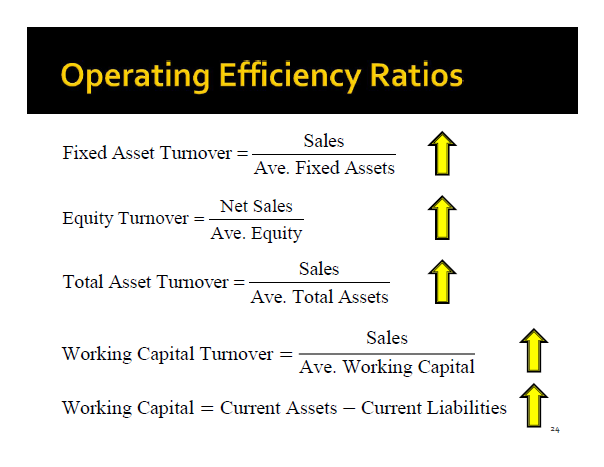

- Efficiency

- Cost control

- Shareholder value analysis

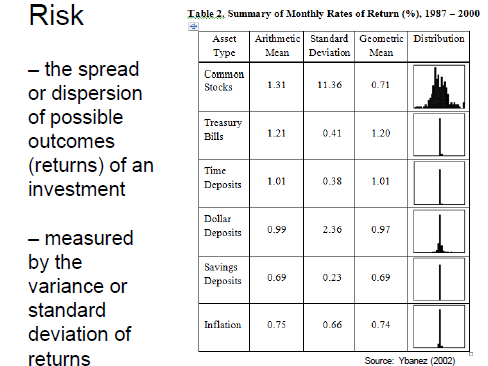

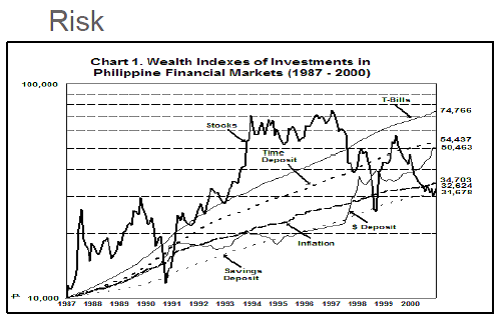

Risk

- Market risk

- Financial risk & flexibility

- Leverage

- Solvency

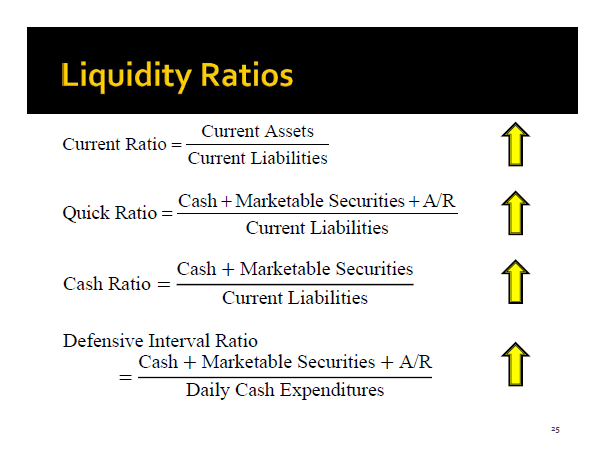

- Liquidity

- Quality of earnings

Value of Financial Analysis Ratio Analysis

- Evaluation of past performance

- To assess a firm’s current financial position, condition and performance

- Gain insights useful for projecting future results

- Microeconomic relationships within a company

- A company’s financial flexibility, the ability to obtain cash to grow the business, ability to pay obligations, etc.

- Management’s capability

- 4. It is of interest to shareholders, creditors, regulators, and the firm’s own management

- 5. Ratios can “standardize” F/S information and make it possible to compare companies of varying sizes

Ratios are not the end-game answers. Ratios are just the starting point and indicate where to conduct further investigation. Anyone can crunch the numbers and generate the ratio. The real skill is putting life into the numbers

Calculate ratios and compare them with:

- Planned ratio for the period

- Ratio during preceding period

- Ratio for a similar firm

- Average ratio for other firms in the industry

Limitations

- Companies may have divisions operating in many different industries, which can make it difficult to find comparable industry ratios at the parent company level

- Some ratios might indicate conflicting signal

- The need to use human judgment

- The use of alternative accounting methods

Issues

Earnings quality issues

- Timing of revenue recognition

- Establishment of reserves for losses

- Amortization process for intangible assets

- “Big bath accounting”

- Recurring vs. Non-recurring Earnings

Balance Sheet issues

- Off balance sheet financing

- Problems Caused by Inflation

- “Inventory profit” as a result of the timing of price increases

- Choice of inventory valuation methods a. Last-in, First-out (LIFO) (allowed by US GAAP)

- First-in, First-out (FIFO)

- Weighted Average (WAVE)

- 5. Rising interest rates causing a decline in the value of long-term debt

- 6. Revenues and expenses appear higher compared to previous periods

Financial Ratios

Time-series analysis (Horizontal Analysis) – Sometimes called the trend analysis, this is a comparative financial statement over a given period

- Use a base year

- Year to year changes

Cross-section analysis (Vertical – Analysis) Sometimes called the common size balance sheet, cash flow and income statement, this technique is about comparing a given firm’s ratios with those of other firms for a specific period.

Common size Balance Sheet:

- All items as a % of Total Assets

- Total Assets = 100%

Common size Income Statement

- All items as a % of Total Revenues

- Total Revenues = 100%

Common size Statement of Cash Flows:

- All items as a % of Total Revenues

- All cash inflow as a % of total inflows AND all cash outflows as a % of total outflows

Quality of Earnings

Quality of earnings emphasizes the degree of reliability of information about economic values as communicated by reported earnings

How to show High quality earnings

- Convert to cash

- Derived from recurring transactions related to the basic business of the company

- Stable, predictable, and indicative of future earnings levels

- Consistent, conservative accounting policies that result in prudent measurement

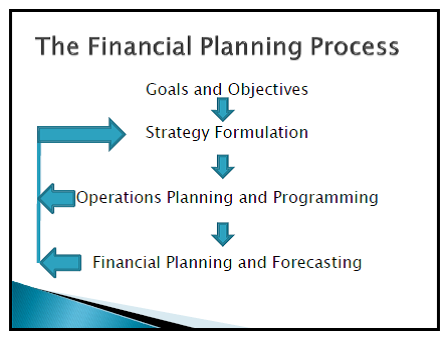

Financial Planning

- Forecast sales

- Prepare forecast income statement (e.g. using a percentage of sales method)

- Prepare a forecast balance sheet. Identify assets and liabilities that “spontaneously” increase or decrease with sales.

- Compute Additional Funds Needed (AFN)

- Determine the financing plan.

- Feedback costs of financing plan in the forecast income statement.

AFN Formula: Required Increase in Assets – Spontaneous Increase in Liabilities – Increase in Retained Earnings

Factors affecting AFN

AFN = f(sales growth, capital intensity*, payout ratio, spontaneous liabilities-to-sales ratio, profit margin)

*Capital intensity = ratio of assets required per sales peso

- Assumptions in the Usage of the Percentage of Sales Method

- Constant Ratios

- Identical Growth Rates

- Be alert on situations where assumptions do not hold o Economies of Scale o Lumpy Assets

- Disproportionate growth rates

Working Capital Management

A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other. Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses.

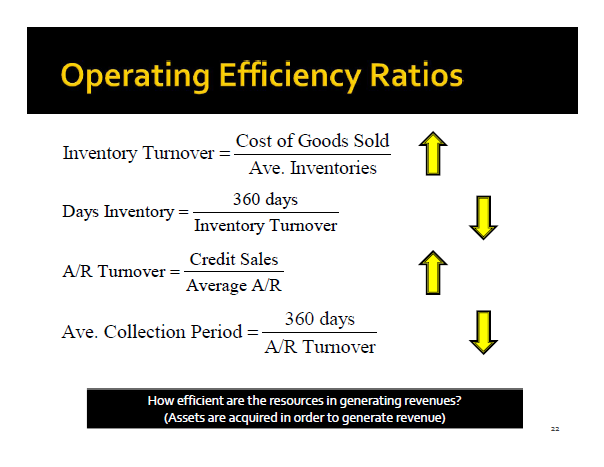

Cash Conversion Cycle = Days Receivables + Days Inventory – Days Payable

Days Inventory = 365 / Inventory Turnover Ratio (COGS/Ave Inventory)

Indicates the length of the period between the purchase and the sale of inventory during each operating cycle

Days Receivable = 365 / AR Turnover Ratio (Sales/Ave Receivables)

Indicates the length of the period between the sale of inventory and the collection of cash from customers during each operating cycle

Days Payable = 365 / AP Turnover Ratio*

Indicates the length of the period between the purchase of inventory on the account and the payment of cash to suppliers during each operating cycle

*AP Turnover Ratio = Purchases on Account / Average AP NE Cycle = DI + DR – DP Operating Cycle = DI + DR

WC Management and Policy

1. Investment and financing decisions affecting working capital

2. Trade-off between profitability and risk

Components: Cash • Minimum cash balance – determined by stability of inflows and outflows • Interest rate: if high ? keep cash balance low • Credit lines: more credit lines ? keep cash balance low Accounts Receivables o Credit cards – no credit risk, but high cost, with some delay in getting the money o Evaluating criteria • Terms • Installment • Interests (for delayed payment) • Discounts (for prompt payment) • Who will be granted / refused credit – customer information screening • Limit • Collection system – available options like bank, internet, bayad centers o High interest rates ? less generous with credits o Can also be affected by competitive pressures and operating costs Inventories o High interest ? low inventories (keep everything low)Accounts Payable o Trade Credit – not only an act of buying but also a relatively easy to avail act of financing • Cost of credit: non-availment of discounts (ex. 3/10 net 30 means you have 30 days after the sale to pay, but if you pay within 10 days, you’ll get a 3% discount on the amount you have to pay)

o Relatively easy to stretch this type of payable and delay payment, although care should be taken to avoid impairing supplier relationships

Short-term Loan o Usually used for meeting seasonal requirements o Costs of Credit lines • Commitment fees (you have to pay this even if you don’t use it) • Compensating balance (to be maintained in the account)

o Revolving credit – borrow and repay as you are able to up to a certain minimum

Other Important Things to Observe:

- Growth – usually requires long-term financing

- Seasonality – normally addressed through short-term financing

- Inefficiencies – eliminate (check through Inv TO & A/R TO measures)

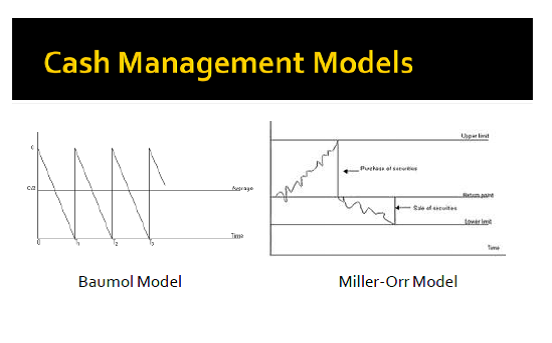

Cash Management

– A detailed forecast of cash inflows and outflows over a specified period

– How much cash should a firm have?

o Holding and ordering costs for cash

o Concept and effect of float

– Major sources of cash inflows

• Receivables collections

• Collections from other revenue sources

• Major sources of cash outflows

• Salaries/wages

• Rent and other overheads

• Purchases payments

Cash Balances

o Transactions – Used for operations

o Compensating – minimum balance that must be maintained in an account used to offset a portion of the cost that a bank faces when extending a loan or credit

o Precautionary – Cash balance held to take advantage of an unpredictable (but probable) chance of a bargain.

o Speculative – Cash reserve kept for an unforeseen emergency.Table of Contents

Capital Budgeting

The process in which a business determines whether projects are worth pursuing. A prospective project’s lifetime cash inflows and outflows are assessed in order to determine whether the returns generated meet a sufficient target benchmark.

1. Evaluating Projects Methods

a. Return on investment

b. Economic value-added

c. Payback

i. Payback Period = (Cost of Project/Annual Cash Inflows)

d. Discounted cash flow analysis: net present value and internal rate of return

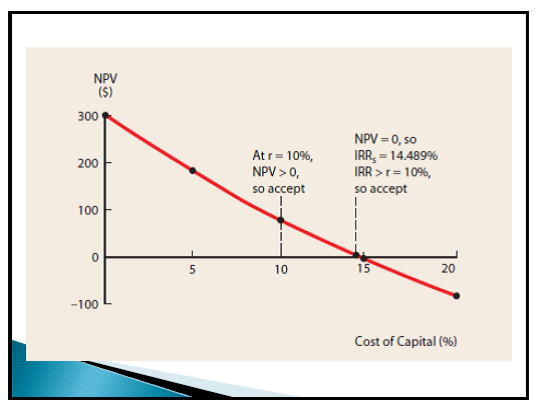

2. NPV and the goal of increasing shareholder value

Net Present Value (NPV)

1. Method that allows the direct comparison of future cash flows with present cash flows by expressing all cash flows in terms of current peso values

2. Difference between the present value of future cash flows of a project and its initial investment

3. NPV Rule: Managers increase shareholder value by investing in projects with a positive net present value.

4. If you raise the discount rate, the NPV declines. There is an inverse relationship between NPV and discount rate.

5. NPV is one of two methods using discounted cash flows. The other one is internal rate of return (IRR).

6. Main Features:

a. Additivity property

b. Based on the Discounted Cash Flow (DCF) model – takes into account the time value of money

c. It is a measure of wealth – measure tied to the ultimate objective

Components:

– IO = Initial Outlay

– CF = Cash Flows

– r = Required rate of return (Risk-return tradeoff)

– n = Number of periods

General Formula:

NPV = -IO + CF1 + … + CFn

(1+r)1 (1+r)n

Internal Rate of Return (IRR)

1. The rate of return at which NPV = 0

2. IRR Rule: Managers increase shareholder value if the project’s IRR > opportunity cost of capital.

Dangers of IRR:

– Multiple IRR’s

– Mutually Exclusive Projects can give conflicting signals between IRR & NPV – This is where the Incremental IRR Approach is used

– Capital Rationing

– Unequal Lives (Choosing between Long- and Short- Lived Equipment)

• Replacement/Investment Timing

DCF Guideline

1. Discount cash flows, not profits

2. Discount incremental cash flows (cash flows with project less cash flows without project)

a. Include all indirect effects

b. Forget sunk costs but recognize depreciation tax shield.

c. Include opportunity costs.

d. Recognize investment in working capital.

3. Discount nominal cash flows with nominal cost of capital.

4. Assume all equity financing. Separate the investment and financing decision.

Cost of Capital

– rate of return that shareholders could expect to earn if they invested in equally risky securities

– Cost is a function of risk and the time value of money.

– Debt is always the least expensive source of capital.

– Equity is always the most expensive source of capital.

– Retained earnings is a form of equity; retained earnings has a lower cost than other equity because you are in control of the business.

Costs of Financing (least to costly)

1. Bank and senior debt

2. Junior and subordinated debt

3. Preferred stock

4. Retained profits

5. Common stock

a. Public

b. Private

Yield Curve

o A normal yield curve is one in which longer maturity bonds have a higher yield compared to shorter-term bonds due to the risks associated with time.

Computing returns

o Market rate of interest is the required rate of return on the debt instrument. If the investor holds on the instrument until maturity, he/she earns the market rate of interest. This rate is also called YIELD TO MATURITY.

o Rate of Return: Equity – Return on equity instruments have 2 sources: dividends and capital appreciation

• Total equity return = dividend yield + capital gain as a % of price

Risk Variability Returns

Benchmarks for Risk: the risk-free rate and Market Risk Premium

o Risk-Return Benchmarks

o Risk-free rate – government securities

o Market rate of return for all risky assets – returns from investing in a portfolio corresponding to the stock market index

o Market risk premium – additional return investors seek or require from an investment in a risky asset; equals the market return less risk-free rate

Risk and diversification

o Unique risk – risk that can be eliminated through diversification

o Market risk – risk that cannot be diversified away; vulnerability to macroeconomic changes that affect all stocks

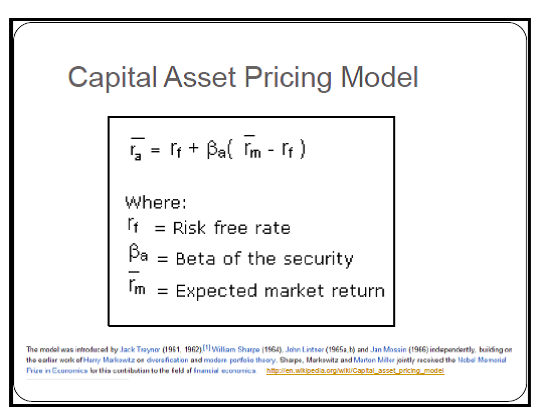

Beta and the capital asset pricing model

The sensitivity of an individual stock to market risk/movements is called its beta.

1. The average beta of all stocks is 1.0.

2. If beta > 1.0, the stock is particularly sensitive to market fluctuations. If beta < 1.0, the security is not so sensitive.

3. The expected return of any stock is a function of the risk free rate, the market risk premium, and its beta. This is the CAPM.

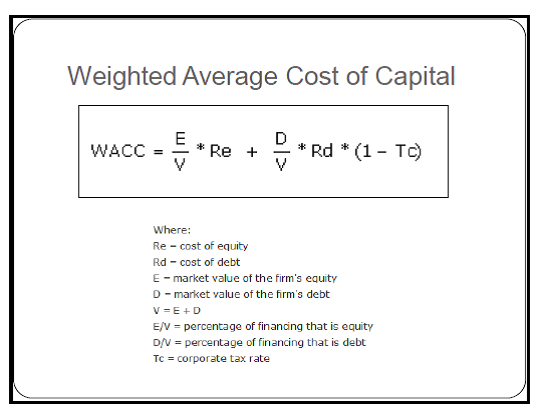

Cost of Capital and Capital Budgeting

1. The cost of capital used for capital budgeting purposes depends on the project’s risk. If the project being evaluated is of the same risk as the company’s existing businesses, then the company’s cost of capital is the appropriate discount rate for the project.

2. Companies adjust corporate WACC if the project being considered is not of the same risk as their existing businesses.

3. The discount rate should NOT be adjusted for possible errors or variability in forecast cash flows. Cash flows used for DCF analysis should be expected cash flows that already reflect the probabilities of all possible outcomes, good and bad. Potential bad outcomes should be reflected in the discount rate only to the extent that they affect beta.

Effect of Capital Structure on Cost of Capital

1. When a firm issues both debt and equity securities, its cost of capital must be a weighted average of the returns demanded by debt and equity investors.

2. The weights are based on the relative market values of debt and equity in the firm’s capital structure.

3. Cost of equity may be based on CAPM; cost of debt should be net of tax.

4. Risk Return Trade-off – The principle that potential return rises with an increase in risk. Low levels of uncertainty (low-risk) are associated with low potential returns, whereas high levels of uncertainty (high-risk) are associated with high potential returns. According to the risk-return tradeoff, invested money can render higher profits only if it is subject to the possibility of being lost.

Corporate Financing

2 Basic Financing Decisions:

1. How much profit should be plowed back into the business rather than paid out as dividends?

o Dividend policy

2. What proportion of the deficit should be financed by borrowing rather than by an issue of equity?

o Debt policy

Reasons for relying on internal funds:

– Cost of issuing new securities is avoided

– Announcement of a new equity issue is usually bad news for investors, who worry that the decision signals lower future profits or higher risk

Common Stock

– Authorized share capital – maximum number of shares that can be issued

– Issued and outstanding – held by investors

– Treasury shares – held in the company’s treasury until they are either canceled or resold; issued but not outstanding

– Par value – value at which issued shares are entered into the company’s books; has little economic significance

– Additional paid-in capital – difference between the price at which new shares are sold and the par value of these shares

– Majority voting – each director is voted upon separately and stockholders can cast one vote for each share that they own

– Cumulative voting – directors are voted upon jointly and stockholders can allot all their votes to just one candidate

Preferred Stock

– Offers a series of fixed payments to the investor

– Company can choose not to pay a preferred dividend, but in that case it may not pay a dividend to its common stockholders

– Cumulative preferred stock – the firm must pay all past preferred dividends before common stockholders get a cent

Debt

– Promise to make regular interest payments and to repay the principal

– This liability is limited – stockholders have the right to default on the debt if they are willing to hand over the corporation’s assets to the lenders (but they will choose to do this only if the value of the assets is less than the amount of the debt)

– Lenders do not have any voting power

– Interest payments are regarded as a cost and are deducted from taxable income (interest is paid from before-tax income, whereas dividends are paid from after-tax income)

Mixture of loans reflects the response to the ff. questions:

1. Should the company borrow short-term or long-term?

2. Should the debt be fixed or floating rate?

3. Should you borrow dollars or some other currency?

4. What promises should you make to the lender?

a. Senior debt – first to be repaid (before junior or subordinated debt)

b. Secured – firm sets aside some of its assets (collateral) specifically for the protection of the creditor

5. Should you issue straight or convertible bonds (give the option to exchange the bond for a predetermined number of shares)?

Contributions of financial intermediaries:

1. Payment mechanism

2. Borrowing and lending – channeling savings toward those who can best use them

3. Pooling risk

&nbps;

Debt Policy

Capital structure – the firm’s mix of different securities

find the combination of securities that has the greatest overall appeal to investors, the combination that maximizes the market value of the firm

Mondigliani and Miller – propositions depend on PERFECT CAPITAL MARKETS! Payout policy doesn’t matter in perfect capital markets; also showed financing decisions don’t matter in perfect markets

Proposition I: The market value of any firm is independent of its capital structure.

– As long as investors can borrow or lend on their own account on the same terms as the firm, they can “undo” the effect of any changes in the firm’s capital structure

– Firm value is determined on the left-hand side of the balance sheet by real assets

– We implicitly assume that both companies and individuals can borrow and lend at the same risk-free rate of interest

– Leverage increases the expected stream of earnings per share but not the share price – the change in the expected earnings stream is exactly offset by a change in the rate at which the earnings are capitalized

Proposition II: The expected rate of return on the common stock of a levered firm increases in proportion to the debt-equity ratio (D/E), expressed in market values; the rate of increase depends on the spread between rA, the expected rate of return on a portfolio of all the firm’s securities, and rD, the expected return on the debt.

– Note that rE = rA if the firm has no debt

– rA = expected OI

MV of all securities

– The borrowing decision also does not affect the expected return on the firm’s assets rA

– rA = (proportion of debt x expected return on debt)

+ (proportion of equity x expected return on equity) ?

– rA = (D/(D+E) x rD) + (E/(D+E) x rE)

– rE = rA + D/E (rA – rD)

– As the firm borrows more, the risk of default increases and the firm is required to pay higher rates of interest

– The more debt the firm has, the less sensitive rE is to further borrowing

– As the firm borrows more, more of that risk is transferred from stockholders to bondholders – holders of risky debt bear some of the firm’s business risk

– How can shareholders be indifferent to increased leverage when it increases expected return?

o Any increase in expected return is exactly offset by an increase in risk and therefore in shareholders’ required rate of return!

– B A = (proportion of debt x beta of debt) +(proportion of equity x beta of equity)

– B A = (D/(D+E) x B D) + (E/(D+E) x B E)

– B E = B A + D/E(B A – B D)

– Investors require higher returns on levered equity because the required return simply rises to match the increased risk!

WACC – weighted-average cost of capital

– WACC = rA = (D/V x rD) + (E/V x rE)

Market imperfections: Debt policy DOES matter!

– Taxes

– Costs of bankruptcy and financial distress

– Conflicts of interest, information and incentive problems|

Corporate Taxes

– Interest is tax-deductible, dividends and retained earnings are not

– Thus return to bondholders escapes taxation at the corporate level ? Tax shield

– PV (tax shield) = corporate tax rate x debt

– PV (tax shield) = Tc x D

– The firm’s objective should be to arrange its capital structure so as to maximize after-tax income

– Relative tax advantage of debt = 1 – Tp

(1 – TpE)(1 – Tc)

o Tp = personal tax rate on interest

o TpE = effective personal rate on equity income

– If all equity income comes as dividends, debt and equity income are taxed at the same effective personal rate, and relative advantage depends only on the corporate rate:

o Relative advantage = 1

1 – Tc

– Value of the firm = Value if all-equity-financed + PV(tax shield)

– Why value of interest tax shields may be overstated:

o It’s wrong to think of debt as fixed and perpetual

o You can’t use interest tax shields unless there will be future profits to shieldCosts of Financial Distress- Financial distress – occurs when promises to creditors are broken or honored with difficulty

– Value of firm = Value if all-equity-financed + PV(tax shield)

– PV(costs of financial distress)

– PV(tax shield) initially increases as the firm borrows more, but at some point the probability of financial distress increases rapidly with additional borrowing

– Tradeoff Theory of Capital Structure: The theoretical optimum is reached when the present value of tax savings due to further borrowing is just offset by increases in the present value of costs of distress

o Target debt ratios may vary from firm to firm; companies with safe, tangible assets and plenty of taxable income to shield ought to have high target debt ratiosBankruptcy costs- Corporate bankruptcies occur when stockholders exercise their right to default

– Limited liability allows stockholders simply to walk away from trouble, leaving the trouble to the creditors; former creditors become the new stockholders

– Bankruptcy is merely a legal mechanism for allowing creditors to take over when the decline in the value of assets triggers a default; bankruptcy is not the cause of the decline in value but the result!

– Bankruptcy costs are the costs of using this legal mechanism allowing creditors to take over when the firm defaultsAgency costs

-The more the firm borrows, the greater is the temptation to play the games (e.g. cash in and run, playing for time)The Pecking Order of Financing Choices

– Asymmetric information – managers know more about their companies’ prospects, risks, and values than do outside investors

– Pecking order – investment is financed first internal funds, reinvested earnings primarily; then by new issues of debt, and finally with new issues of equity.

Implications of the Pecking Order:

1. Firms prefer internal finance.

2. They adapt their target dividend payout ratios to their investment opportunities, while trying to avoid sudden changes in dividends.

3. Sticky dividend policies, plus unpredictable fluctuations in profitability and investment opportunities, mean that internally generated cash flow is sometimes more than capital expenditures and other times less. If it is more, the firm pays off debt or invests in marketable securities. If it is less, the firm first draws down its cash balance or sells its marketable securities.

4. If external finance is required, firms issue the safest security first. That is, they start with debt, then possibly hybrid securities such as convertible bonds, then perhaps equity as a last resort.Kinds of DebtForeign bonds

Kinds of Debt

Foreign bonds

– Bonds that are sold to local investors in another country’s bond market

Indenture (or trust deed)

– Bond agreement between the borrower and a trust company (representing the bondholders) in the case of a public issue

Bond price

– Shown as a percentage of face value

– Price is stated net of accrued interest

– Sometimes bonds are sold with a lower interest payment but at a larger discount on their face value, so investors receive a significant part of their return in the form of capital appreciation

Zero-coupon bond

– Pays no interest at all; the entire return consists of capital appreciation

Debentures

– Longer-term unsecured issues

Notes

– Shorter-term issues

Mortgage bonds

– Form a majority of secured debt

Asset-backed securities

– When companies bundle up a group of assets and then sell the cash flows from these assets

Sinking fund

– Part of the issue is repaid on a regular basis before maturity

Call option

– Allows the company to pay back the debt early

– Exercised when interest rates fall and bond prices rise, to be able to issue another at a higher price and a lower interest rate

– Call the bond when, and only when, the market price reaches the call price!

Puttable bonds

– Give investors the option to demand early repayment

Extendible bonds

– Give investors the option to extend the bond’s life

Project finance

– Debt supported by a particular project

Dividend Policy

Dividend policy – the trade-off between retaining earnings on the one hand and paying out cash and issuing new shares on the other

Factors Affecting Dividend Policy

1. Legal requirements

a. Firm’s liquidity position

2. Repayment need

3. Expected rate of return (Future Investments)

4. Stability of earning

5. Desire of control

6. Access to the capital market

7. Shareholder’s individual tax situation

Dividends

– Shares are sold cum dividend until a few days before the record date, at which point they are trade ex dividend

– Companies are not allowed to pay a dividend out of legal capital (par value of outstanding shares)

– Taxed as ordinary income

Forms of dividends

1. Cash dividend – regular or one-off special dividend

2. Stock dividend – like a stock split; increases the number of shares, but the company’s assets, profits, and total value are unaffected. Thus it reduces value per share.

o Stock dividend – shown in the accounts as a transfer from retained earnings to equity capital

o Stock split – reduction in the par value of each share

Share repurchase

– Reacquired shares may be kept in the company’s treasury and resold if the company needs money

– Stockholders who sell shares to the firm pay tax only on capital gains realized in the sale

Lintner’s Model – Stylized facts:

1. Firms have long-run target dividend payout ratios.

2. Managers focus more on dividend changes than on absolute levels.

3. Dividend changes follow shifts in long-run, sustainable earnings.

4. Managers are reluctant to make dividend changes that might have to be reversed.

Target Div: DIV1 = target ratio x EPS1

Target Change: DIV1 – DIV = target ratio x EPS1 – DIV0

– But shareholders prefer a steady progression in dividends; they would move only partway toward their target payment.

– DIV1-DIV0 = adjustment rate

x (target ratio x EPS1 – DIV0)

– The more conservative the company, the lower would be its adjustment rate

Information in Dividends and Stock Repurchases

– Most managers don’t increase dividends until they are confident that sufficient cash will flow in to pay them

– Announcements of dividend cuts are usually taken by investors as bad news (stock price falls) and dividend increases are good news (stock price rises)

– Investors do not get excited about the level of a company’s dividend; they worry about the change

– A company that announces a repurchase program is not making a long-term commitment to earn and distribute more cash

– Companies repurchase shares when they have accumulated more cash than they can invest profitably or when they wish to increase their debt levels – Shareholders are frequently relieved to see companies paying out the excess cash rather than frittering it away on unprofitable investments

– Stock repurchases may also be used to signal a manager’s confidence in the future

– When companies offer to repurchase their stock at a premium, senior management and directors usually commit to hold onto their stock

The Dividend Controversy: Does a dividend decision change the value of a stock, rather than simply providing a signal of stock value?

– Rightists – conservative group which believes that an increase in dividend payout increases firm value

o There is a natural clientele for high-payout stocks

o There is also a natural clientele of investors who look to their stock portfolios for a steady source of cash to live on

o Dividends signal a more careful, value-oriented investment policy

– Leftists – radical group which believes that an increase in dividend payout reduces value

o Whenever dividends are taxed more heavily than capital gains, firms should pay the lowest cash dividend they can get away with; available cash should be retained or used to repurchase shares

o Investors should pay more for stocks with low dividend yields / accept a lower pretax rate of return from securities offering returns in the form of capital gains rather than dividends

– Middle-of-the-road party – claims that dividend policy makes no difference

o Modigliani and Miller – irrelevance of dividend policy in a world without taxes, transaction costs, or other market imperfections

o The only way to finance extra dividend is to sell shares – Capital loss borne by old shareholders just offsets the extra cash dividend they receive

o Old shareholders can cash in by selling some of their shares

o Enough firms may have switched to low-payout policies to satisfy fully the clientele’s demand; no incentive for additional firms to switch to low-payout policies

– Taxes on dividends have to be paid immediately, but taxes on capital gains can be deferred until shares are sold and capital gains are realized

– Rule: Adopt a target payout that is sufficiently low as to minimize reliance on external equity

Dividend Theories

Dividend Irrelevance Theory

Much like their work on the capital-structure irrelevance proposition, Modigliani and Miller also theorized that, with no taxes or bankruptcy costs, dividend policy is also irrelevant. This is known as the “dividend-irrelevance theory”, indicating that there is no effect from dividends on a company’s capital structure or stock price.

In the determination of the value of a company, dividends are often used. However, MM’s dividend-irrelevance theory indicates that there is no effect from dividends on a company’s capital structure or stock price. MM’s dividend-irrelevance theory says that investors can affect their return on a stock regardless of the stock’s dividend.

Bird-in-the-Hand Theory

The bird-in-the-hand theory, however, states that dividends are relevant. Remember that total return (k) is equal to dividend yield plus capital gains. Myron Gordon and John Lintner (Gordon/Litner) took this equation and assumed that k would decrease as a company’s payout increased. As such, as a company increases its payout ratio, investors become concerned that the company’s future capital gains will dissipate since the retained earnings that the company reinvests into the business will be less.

Tax-Preference Theory

Taxes are important considerations for investors. Remember capital gains are taxed at a lower rate than dividends. As such, investors may prefer capital gains to dividends. This is known as the “tax Preference theory”.

Additionally, capital gains are not paid until an investment is actually sold. Investors can control when capital gains are realized, but, they can’t control dividend payments, over which the related company has control.

Dividend Signaling

A theory that suggests company announcements of an increase in dividend payouts act as an indicator of the firm possessing strong future prospects. The rationale behind dividend signaling models stems from game theory. A manager who has good investment opportunities is more likely to “signal” than one who doesn’t because it is in his or her best interest to do so.

Clientele Effect

The theory that a company’s stock price will move according to the demands and goals of investors in reaction to a tax, dividend or other policy change affecting the company. The clientele effect assumes that investors are attracted to different company policies, and that when a company’s policy changes, investors will adjust their stock holdings accordingly. As a result of this adjustment, the stock price will move.

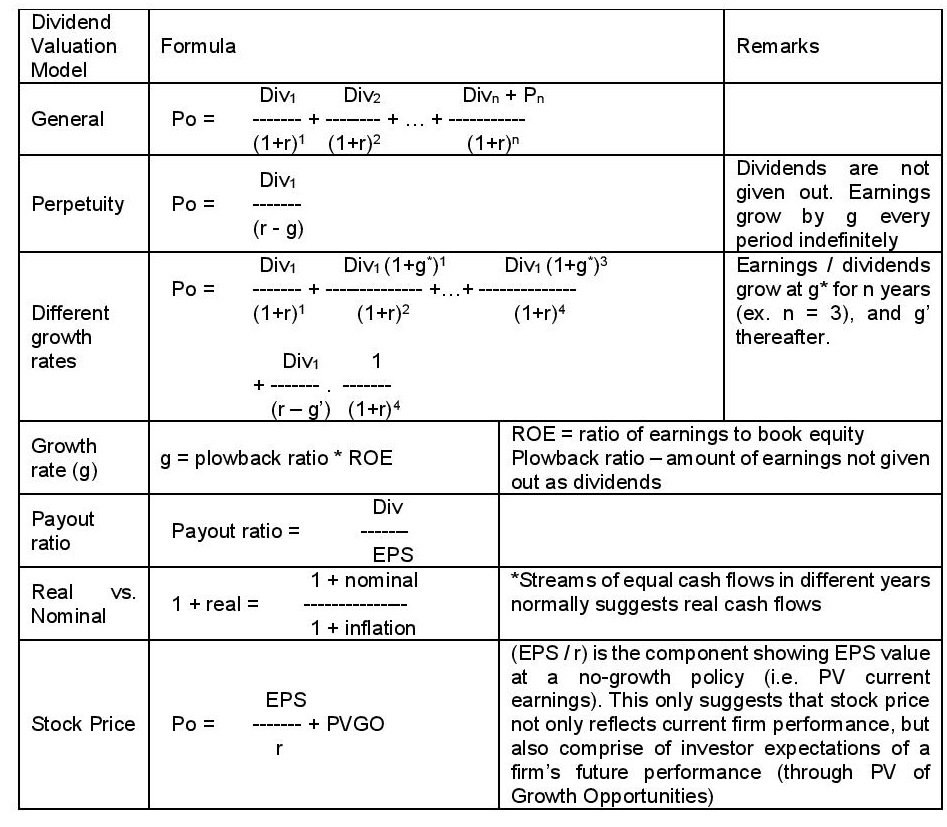

Relevant Formulas

4 thoughts on “Finance Cheat Sheet: Formulas and Concepts”

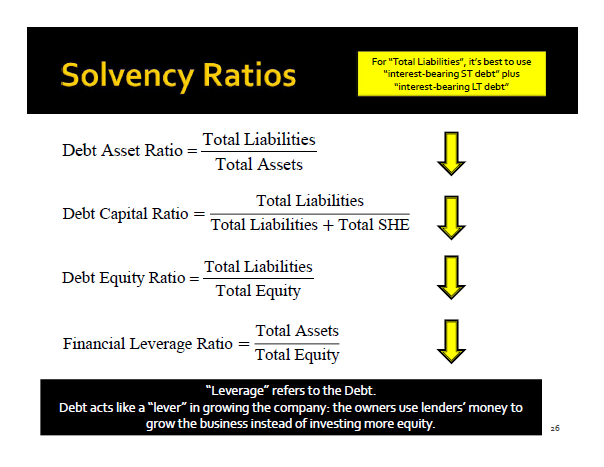

What the hell is SHE?? the acronym is nowhere to be found and not explained…..

Also debt isn’t total liabilities, debt is a liability but it isn’t ALL liabilities.

Otherwise very helpful. but these parts are extremely confusing

It’s Shareholders Equity. Technically it is but debt is just a common term used for liability.

Thanks FOR YOUR GREAT FINANCE IFORMATION I WAS LOOKING TO FIND IT EVERY WHERE

2.1 A firm projects an ROE of 18%; it will maintain a payout ratio of 40%. The firm is

expecting earnings of R3 per share and investors expect a return of 15% on the

investment. Calculate the expected share price and the P/E ratio of the firm

How would you solve this question